OfficeMax 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

a part of this program by $130.0 millionat the end of 2004. The decrease in sold accounts receivable

of $130.0 million used cash from operations in 2004.

Through October 28, 2004, some ofour employees were covered by noncontributory defined

benefit pension plans. Effective July 31, 2004, we established separate mirror plans for active

employeesin the paper and forest products businesses, and transferred theassociated assets and

obligations to the new plans. Effective October 29, 2004, under the terms of theAsset Purchase

Agreement with affiliates of Boise Cascade, L.L.C., we transferred sponsorship of the plans covering

active employees ofthe paper and forest products businesses to Boise Cascade, L.L.C. As a result,

only those terminated, vested employees and retirees whose employment with us ended onor before

July 31, 2004, and some active OfficeMax, Contract employees were covered under the plans

sponsored by us.Pension expense was$13.7 million and $21.7million in 2006 and 2005,

respectively. Pension expense for the year ended December 31, 2004, was $169.7 million, including

$94.9 million of curtailment expense related to the Sale. These are non-cash charges in our

consolidated financial statements. In 2006 and 2005, we made contributions to our pension plans

totaling $9.6 million and $2.8 million, respectively. In 2004,we made cash contributions to our

pension plans totaling $279.8 million. The Asset Purchase Agreementwith affiliates of Boise

Cascade, L.L.C., required us to fully fund the planscovering active employees of the paper and forest

products businesses on an accumulated-benefit-obligationbasis using a6.25% liability discount rate.

Since our active employees who are covered by the retained plans, as well as all of the inactive

participants, are no longer accruing additional benefits, we expect our future contributionstothese

plans to be greatly reduced. The minimum required contribution in 2007 is approximately $11 million.

However, we may elect to make additional voluntary contributions. See “Critical Accounting

Estimates” in this Management’s Discussion and Analysis of Financial Condition and Results of

Operations for more information.

Investment Activities

Our cash investing activities used cash of $163.9 million in 2006 and $97.3million in2005and

provided $1.6 billion of cash in 2004. Cash from investing activities in 2004 was primarily due to the

Sale.

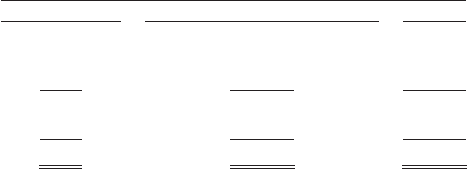

Our principal investing activities are related to capital expenditures and acquisitions. Investing

activities during2006included capital expenditures of $176.3 million. Our capital spending in 2006

primarily related to leasehold improvements, new stores, quality and efficiency projects, replacement

projects and integration projects, including our previously announced infrastructure improvement

initiatives in supply chain and information systems. Details of 2006 capital investment by segment are

included inthe table below:

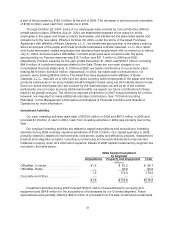

2006 Capital Investment

by Segment

Acquisitions Property and Equipment Total

(millions)

OfficeMax, Contract......................$1.5$81.2$ 82.7

OfficeMax, Retail.........................— 93.693.6

1.5 174.8 176.3

Corporate and Other .....................— ——

$ 1.5 $ 174.8 $ 176.3

Investment activities during2005 included $152.5millionof expenditures for property and

equipment and $34.8 million for theacquisitionsof businesses by our Contract segment. These

expenditures were partially offset by$93.3 million of proceeds from the sale of restricted investments.