OfficeMax 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

See accompanying notes to consolidated financial statements.

47

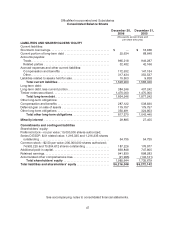

OfficeMax Incorporated and Subsidiaries

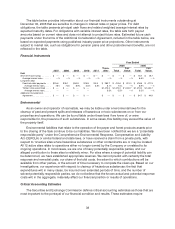

Consolidated BalanceSheets

December 30,

2006

December 31,

2005

(thousands except share and

per-share amounts)

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities:

Short-term borrowings........................................ $—$ 18,666

Current portion oflong-term debt.............................. 25,634 68,648

Accounts payable:

Trade. .................................................... 965,218 949,287

Related parties............................................ 32,482 42,166

Accrued expenses and other current liabilities:

Compensation and benefits................................. 172,632 147,184

Other. .................................................... 317,434 352,537

Liabilities relatedto assets held for sale ......................... 15,503 9,838

Total current liabilities................................... 1,528,9031,588,326

Long-term debt:

Long-term debt, less currentportion ............................ 384,246 407,242

Timber notessecuritized ...................................... 1,470,0001,470,000

Total long-term debt..................................... 1,854,2461,877,242

Other long-term obligations:

Compensation and benefits ................................... 287,122 538,830

Deferred gain on sale of assets ................................ 179,757 179,757

Other long-term obligations ................................... 350,491 324,853

Total other long-term obligations ......................... 817,370 1,043,440

Minority interest ............................................ 29,885 27,455

Commitments and contingent liabilities

Shareholders’ equity:

Preferred stock—no par value; 10,000,000 shares authorized;

Series D ESOP: $.01 stated value; 1,216,335 and 1,216,335 shares

outstanding ............................................... 54,735 54,735

Common stock—$2.50 par value; 200,000,000 shares authorized;

74,903,220 and 70,804,612 shares outstanding ................ 187,226 176,977

Additional paid-in capital ...................................... 893,848 747,805

Retained earnings............................................ 941,830 898,283

Accumulatedother comprehensive loss. ........................ (91,995) (142,121)

Total shareholders’ equity............................... 1,985,6441,735,679

Total liabilities and shareholders’ equity ...................... $ 6,216,048 $6,272,142