OfficeMax 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60

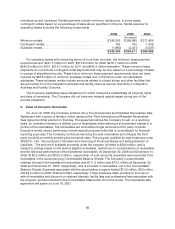

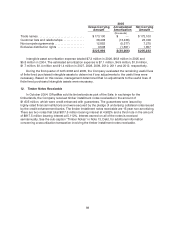

termination and other closure costs. These chargesand expenses were reflectedwithin discontinued

operations in the Consolidated Statementsof Income (Loss).

The assets and liabilities of the wood-polymer building materials facility near Elma, Washington,

are included in current assets ($0.3million at December 31, 2005) and current liabilities ($15.5 million

at December 30, 2006 and $9.8 million at December 31, 2005, respectively) in the Consolidated

Balance Sheets. The assets are reported at their estimated fair value less costs to sell and are no

longer depreciated.

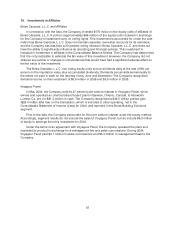

4. Integration Activities and Facility Closures

During 2003, the Company acquired OfficeMax, Inc. for $1.3 billion (the “Acquisition”). Increased

scale as a result of the Acquisitionallowed management to evaluate theCompany’s combined office

products businessand to identify opportunities forconsolidating operations. Costs associated with

the planned closure and consolidation of acquired OfficeMax, Inc. facilities wereaccounted forunder

EITF Issue No. 95-3,“Recognition of Liabilities in Connection with a Purchase Business Combination,”

and recognized as liabilities inconnection with the acquisition and charged to goodwill. Costs

incurred inconnection with all other business integration activities havebeen recognized in the

Consolidated Statement of Income (Loss).

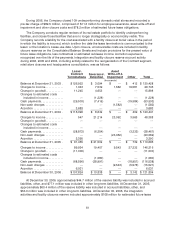

Priortothe Acquisition, OfficeMax, Inc. had identified and closed underperforming facilities. As

part of thepurchase price allocation, the Company recorded $58.7 million of reserves for the

estimated fair value of future liabilities associated with these closures. These reserves related primarily

to future lease termination costs, net of estimated sublease income. In addition to these store

closures, at December 31, 2003, the Company identifiedand closed 45 OfficeMax, Retail facilitiesthat

were no longer strategically and economically viable, and recorded a $69.4 million liability in the

Consolidated BalanceSheet. During 2004, the Company identified and closed an additional 11 stores.

All of the abovecharges were accounted for as exit activities in connection with the acquisition and

were not recorded as charges to income.

Since the Acquisition, the Company has closed 18 U.S. distribution centers and2 customer

servicecenters. In connection with these closures the Company recorded acharge to income in the

Consolidated Statement of Income (Loss) of $29.7 million during 2004.

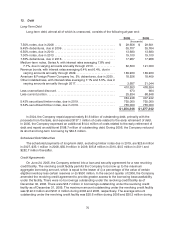

In September 2005, the board of directors approved a plan to relocate and consolidate the

Company’s retail headquarters in Shaker Heights, Ohio and its existing corporate headquarters in

Itasca, Illinois into a new facility in Naperville, Illinois. The Company began the consolidation and

relocation process in the latter half of 2005. As of December 30, 2006, the Company has incurred and

expensed approximately $70.9 million of costs related to theheadquarters consolidation, including

$45.9 million recognized during 2006 and $25.0million recognized during the second half of2005, all

of which wasreflected in the Corporate and Other segment. The consolidation and relocation process

was completed during the secondhalf of 2006.

Also in 2005, theCompany recorded charges to income of $23.2million for the write-down of

impaired assets related to underperforming retail stores and the restructuring of its Canadian

operations.

During 2006, the Company announced the reorganization of the Contract segment, and recorded

a pre-tax charge of$7.3 million for employee severance related to the reorganization. The Contract

segment also recorded an additional $3.0 million of costs during 2006 primarily related to a facility

closure and employee severance.