OfficeMax 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.76

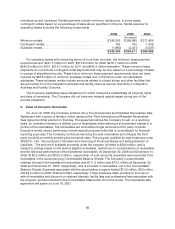

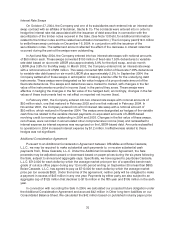

projections. During 2006 and 2005,werecognized accretion expense on the discounted accrual

totaling approximately $6 million inour Consolidated Statements of Income (Loss). Due to recent

increases in actual and projected paper prices, the change in fair value in 2006 resulted inincome of

$48.0 million in our Consolidated Statement ofIncome (Loss). As a result,at December 30, 2006, the

net amount recognized inour Consolidated Balance Sheet related to the AdditionalConsideration

Agreement (either receivable or payable) was zero. We record changes in the fair value of the

Additional Consideration Agreement in our net income (loss) in the period they occur; however, any

potential payments from Boise Cascade, L.L.C. to us are not recorded in net income (loss) until all

contingencies have been satisfied, which is generally at the end ofa 12-monthmeasurement period

ending on September 30. As ofDecember31, 2006, the averagemarket priceper ton of the

benchmark grade used to calculate payments due underthe Additional Consideration Agreement was

$943. This average is the average for the firstthree months of the 12-month measurement period

endingon September 30, 2007.Market prices for paper are volatile and subject to significant

fluctuations. Accordingly, the average market price per ton for the 12-month period ending on

September 30, 2007 may be significantly different than the average as of December 31,2006.

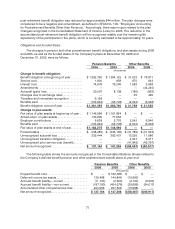

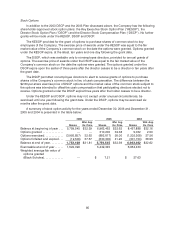

15. Retirement and Benefit Plans

Pension and Other Postretirement Benefit Plans

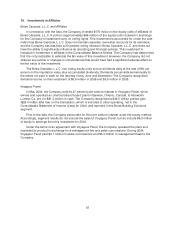

Through October 28, 2004, some ofthe Company’s employees were covered by noncontributory

defined benefit pension plans. Effective July 31, 2004, the Company established separate mirrorplans

for active employees in the paper and forest productsbusinesses, and transferred the associated

assets and obligations tothe new plans. Effective October 29, 2004, under the terms of the Asset

Purchase Agreement,the Company transferred sponsorship of the plans coveringactive employees

of the paper and forest products businesses to Boise Cascade, L.L.C. As a result, only those

terminated vested employees and retirees whose employ ment with the Company ended on or before

July 31, 2004, andsome active OfficeMax, Contract employees, were covered under the pla ns

sponsored bythe Company. OfficeMax, Retail employees, among others, never participated inany of

theCompany’s defined benefit pension plans. The Company’s salaried pension plan was closed to

new entrants on November 1, 2003, and on December 31, 2003, the benefits of eligible OfficeMax,

Contract participants were frozen. Active OfficeMax, Contractemployeeswho were eligible to

participate in the plan on December31, 2003 were credited with oneadditional year ofservice on

January 1, 2004, at a reduced 1% crediting rate.

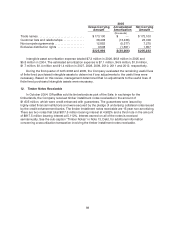

Under the terms of theCompany’s plans, the pension benefit for salaried employees was based

primarily on the employees’ years of service and highest five-year average compensation. The

pensionbenefit for hourly employees was generally based on a fixed amountper year of service. The

Company’sgeneral funding policy is to make contributions to the plans inamounts thatare within the

limits of deductibility under current tax regulations, and not less than theminimum contribution

required by law. The Company generally usesa measurement date consistent withits year end for its

pension plans.

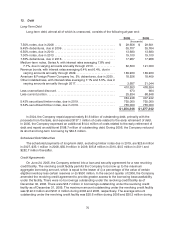

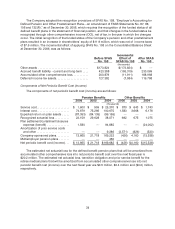

The Company also sponsors various retiree medical benefit plans. The type of retiree medical

benefits and the extent of coverage vary based on employee classification, date of retirement,

location, andother factors. All of the Company’s postretirement medical plans are unfunded. The

Company explicitly reserves the right to amend or terminate its retiree medical plans at any time,

subject only to constraints, if any, imposed by the terms of collective bargaining agreements.

Amendment or termination maysignificantly affect the amount of expense incurred.

During the third quarter of 2005,the Company made changes to its retiree medical benefit plans

that had thenet effect of reducing the medical insurancesubsidy providedto retirees,including

eliminating the subsidy for certain retirees. As a result of these plan changes, the accumulated