OfficeMax 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

hedge, changes in the fair value of the instrument are reported in current earnings and offset the

change in fair value ofthe hedged assets, liabilities or firmcommitments. The ineffective portion of an

instrument’s change infair value is immediately recognized in earnings. Instruments that do not meet

the criteria for hedge accounting or contracts for which the Company has not elected hedge

accounting, are marked to fair value with unrealized gains or lossesreported in earnings.

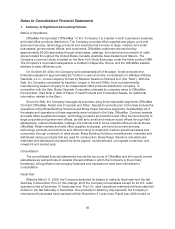

Recently Issued or Newly Adopted AccountingStandards

Following are summaries of recentlyissued accounting pronouncements that have either been

recently adopted or that may become applicable to the preparation of the Company’s consolidated

financial statements in the future.

In December 2004, the Financial Accounting Standards Board (“FASB”)issuedSFAS No. 123R,

“Share Based Payment.” SFASNo. 123R is a revision of SFAS No. 123, “Accounting forStock-Based

Compensation,” and supersedes Accounting Principles Board Opinion (APB) No. 25, “Accounting for

Stock Issued to Employees,” and its related implementation guidance. SFAS No. 123Rfocuses

primarily on accountingfor transactions in which anentity obtains employee services in exchange for

share-based payments. SFAS No. 123R requires entities torecognize compensation expense from all

share-based paymenttransactions in the financial statements.SFAS No. 123R establishes fair value

as the measurement objective in accounting for share-based payment transactions and requires all

companies to apply a fair-value-based measurement method in accountingfor share-based payment

transactions with employees.

Effective January 1, 2006, the Company adopted SFASNo. 123R usingthe modified prospective

transition method. Accordingly, the financial statements for periods prior to January 1, 2006 havenot

been restated to reflect the adoption of SFAS No. 123R.Under the modified prospective transition

method, the Company must record compensation expense for all awards granted after the adoption

date and for the unvested portion of previously granted awards that remain outstanding at the

adoption date, under the fair value method.Previously, the Company recognized compensation

expensefor share-based awards to employees using the fair-value-based guidance in SFAS No. 123.

Due to the fact that theCompany had previouslyaccounted for share-based awards using

SFAS No. 123, the adoption of SFAS No. 123R did not have a material impact on the Company’s

financial position, results of operations or cash flows.

During 2006, the Company adopted SFAS No. 158, “Employer’s Accounting for DefinedPension

and Other Postretirement Plans—an amendment of FASB Statements No. 87, 88, 106 and 132(R).”

This Standard requires that employersrecognize, on a prospective basis, thefunded status of their

defined benefit and postretirement benefit plans in the statement of financial position, and that

changes in the funded status be recognized as acomponent of other comprehensive income, net of

tax. SFAS No. 158 also requires the funded status of a plan to be measured as of the date of the year-

end statement of financial position, and requires additional note disclosures. Therecognition and

disclosure guidance in SFAS No. 158 is effective as ofthe end of the first fiscal year ending after

December 15, 2006, and other measurement elements are effective for fiscal years ending after

December 15, 2008. The Company adopted the recognition provisions of SFAS No. 158 andinitially

applied themto the funded status ofits defined benefit pension and other postretirement benefit plans

as of December 31, 2006. The initial recognition of the funded status of our defined benefit pension

and other postretirement plans resulted in an increase inShareholders’ Equity of $11.9 million, which

wasnet of income taxes of $7.6 million. We currently measure the funded status of ourdefined benefit

plans as of the date of our fiscal year-end statement of financial position, and therefore, the adoption

of themeasurement provisions of SFAS No. 158 willhave no impact onour financial statements.

In June 2006, the FASB issued Interpretation (FIN) No. 48, “Accounting for Uncertainty in Income

Taxes– an interpretation of FASB Statement No. 109.”This Interpretation clarifies the accounting for