OfficeMax 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

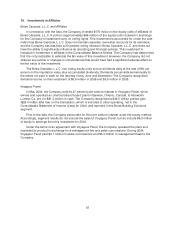

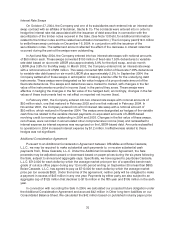

10. Investments in Affiliates

Boise Cascade, L.L.C. and Affiliates

In connection with the Sale, the Company invested $175 million in the equity units of affiliates of

Boise Cascade, L.L.C. A portion (approximately $66 million) of the equity units received in exchange

for the Company’s investment carry no voting rights. This investment is accountedfor under the cost

method as Boise Cascade, L.L.C. does not maintain separateownership accounts for its members,

and the Company has less thana 20 percent votinginterest in Boise Cascade, L.L.C. and does not

have the ability to significantly influence its operating and financial policies. This investment is

included in investment in affiliates in the ConsolidatedBalance Sheets. The Company hasdetermined

that it is not practicable to estimate thefair value of this investment.However, the Company did not

observe any events or changes in circumstances that would have had a significant adverse effect on

the fair value of the investment.

The Boise Cascade, L.L.C. non-voting equity units accrue dividends daily at the rate of8%per

annum on the liquidation value plus accumulated dividends. Dividends accumulate semiannually to

the extent not paid incash on the last day ofany June and December. The Company recognized

dividend income on this investment of$5.9 million in 2006 and $5.5 million in 2005.

Voyageur Panel

In May 2004, theCompany sold its 47 percent joint venture interest inVoyageur Panel, which

owned and operated an oriented strandboard plant in Barwick, Ontario,Canada, to Ainsworth

Lumber Co. Ltd. for $91.2 million incash. The Company recognized a $46.5 million pre-tax gain

($28.4 million after tax) on the transaction, which is included in other operating, net in the

Consolidated Statement of Income (Loss) for 2004, andreported in the Boise Building Solutions

segment.

Prior to the sale, the Company accounted forthis joint venture interest under the equity method.

Accordingly, segment results do not include thesales ofVoyageur Panel, but do include $6.3 million

of equity inearnings from this investmentfor 2004.

Under the terms of anagreement with Voyageur Panel, theCompany operated the plant and

marketed its product in exchange for amanagement fee and sales commissions. During 2004,

Voyageur Panelpaid $2.1 million in sales commissions and $0.4 millioninmanagement fees to the

Company.