OfficeMax 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

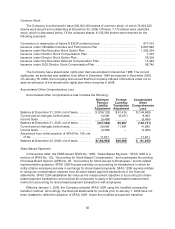

78

The Company adopted the recognitionprovisions of SFAS No. 158, “Employer’s Accounting for

Defined Pension and Other Postretirement Plans—an amendment of FASB Statements No.87, 88,

106 and 132(R),”asofDecember 30, 2006, whichrequires the recognition of the funded status of all

defined benefit plans inthe statement offinancial position, and that changes in the funded status be

recognized through other comprehensive income (OCI), net of tax, in the year in which the changes

occur. Theinitial recognition of thefunded status of the Company’s pension and other postretirement

plans resulted inan increase in shareholders’ equityof $11.9 million, which was net of incometaxes

of $7.6 million. The incremental effect of applying SFAS No. 158 on the Consolidated Balance Sheet

at December 30, 2006, was as follows:

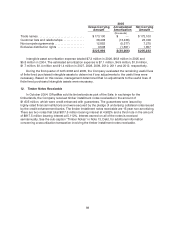

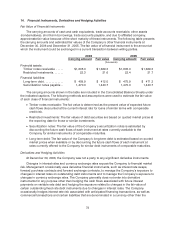

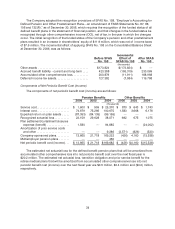

Before SFAS

No. 158

Incremental

Effect of

SFAS No.158

After SFAS

No. 158

(thousands)

Otherassets.................................. $ 173,824 $ (173,824) $ —

Accrued benefit liability - current and long-term....423,388 (193,319 ) 230,069

Accumulatedother comprehensive loss. .......... 200,879 (11,911) 188,968

Deferred incometax assets...................... 127,382 (7,584) 119,798

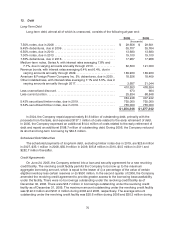

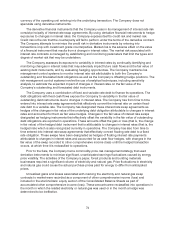

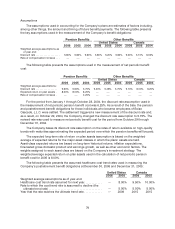

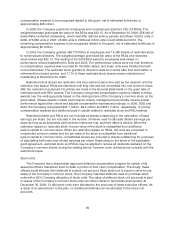

Components of Net Periodic Benefit Cost (Income)

The components of net periodic benefit cost (income) are as follows:

Pension Benefits Other Benefits

2006 2005 2004 2006 2005 2004

(thousands)

Servicecost ...................... $1,600 $ 959 $25,370 $ 870$643 $ 1,743

Interest cost ...................... 74,679 75,26610 0,675 1,583 3,668 6,176

Expected return on planassets ..... (87,353) (84,135)(99,165)—— —

Recognized actuarialloss .......... 23,159 29,628 38,071 692675 1,075

Plan settlement/curtailment/closures

expense (benefit)............... 1,580 —94,885—— (24,002)

Amortization of prior service costs

and other ...................... ——9,386 (3,571) (826) (530)

Company-sponsored plans. ........ 13,665 21,718 169,222 (426) 4,160 (15,538)

Multiemployer pension plans ....... ——460—— —

Net periodic benefit cost (income)... $ 13,665 $ 21,718 $169,682 $ (426) $ 4,160 $(15,538)

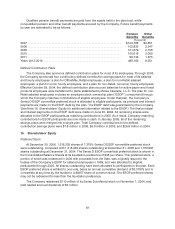

The estimated net actuarial loss for the defined benefit pension plans thatwill be amortized from

accumulated other comprehensive loss into net periodic benefit cost over the nextfiscal year is

$20.2 million. Theestimated net actuarial loss, transition obligation and prior service benefit for the

retiree medical plans that will be amortized from accumulated other comprehensive loss into net

periodic benefit cost (income) over thenextfiscal year are $0.5 million, $0.4 million and ($4.0) million,

respectively.