OfficeMax 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

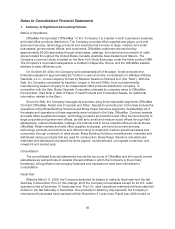

fund outstandingchecks when presented to the financial institutionfor payment. This cash

management practice frequently results in a net cash overdraft position for accounting purposes,

which occurs when total issued checks exceed available cash balances at a single financial institution.

Thecompany records its outstanding checks in accounts payable—trade in the Consolidated Balance

Sheets, and the net change in overdrafts inthe accounts payable—trade lineitemwithin the cash

flows fromoperating activities section of the Consolidated Statements of Cash Flows.

Accounts Receivable

Accounts receivable relate primarily to amounts owed by customers for trade sales of products

and services and amounts due from vendors under volumepurchase rebate, cooperative advertising

and various other marketing programs. An allowance for doubtful accounts is recorded to provide for

estimated losses resulting from uncollectible accounts, and is the Company’s best estimate of the

amount of probable credit losses inthe Company’s existing accounts receivable. Management

believes thatthe Company’s exposure to credit risk associated withaccounts receivable is limited due

to the sizeand diversity of its customer and vendor base, which extends across many different

industries and geographic regions.

The Company has an agreement with a third-party service provider that manages the Company’s

private label credit card program and directly extends credit to customers.

The Company has an accounts receivable securitization program under which it sells fractional

ownership interests in a defined pool of accounts receivable and retains asubordinated interest and

servicing rights to those receivables.The sale of the receivablesunder this program is accounted for

under Statement of Financial Accounting Standards (“SFAS”) No. 140, “Accounting for Transfers and

Servicing ofFinancial Assets and Extinguishments ofLiabilities.” Sold accounts receivable are

excluded from Receivables in the Company’s Consolidated Balance Sheets. The portion ofthe

fractional ownership in thetransferred receivablesthat theCompany retains is included in Receivables

in the ConsolidatedBalance Sheets. See Note 9, Sales ofAccounts Receivable, for additional

information related to the sale of accounts receivable.

At December 30, 2006 and December 31, 2005, the Company had allowances for doubtful

accounts of $15,072 and $22,408, respectively.

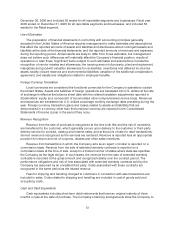

Vendor Rebates and Allowances

TheCompany participates in various cooperative advertising and other marketing programs with

its vendors. The Company also participates in volume purchase rebate programs, some of which

provide for tiered rebates based on defined levels of purchase volume. These arrangements enable

the Company to receive reimbursement for costs incurred to promote the sale of vendor products, or

to earn rebates that reduce the cost of merchandise purchased. Vendor rebates and allowances are

accrued as earned.Rebates and allowances received as a result ofattaining defined purchase levels

are accrued over the incentive period based on the terms of the vendor arrangement and estimates of

qualifying purchases during the rebate program period. These estimates are reviewedon a quarterly

basis andadjusted for changes in anticipated product sales and expected purchase levels.

Volume-based rebates and allowances earned are initially recorded as a reduction in the cost of

merchandise inventories and are included in operations (as a reduction in cost of goods sold) in the

period therelated product is sold. Amounts received under other promotional programs are generally

event-based and are recognized at the time of the event as a reduction of cost of goods sold or

inventory, as appropriate, based on thenatureofthe promotion and the terms of the vendor

agreement. Advertising and other allowances that represent reimbursements of specific, incremental

and identifiable costs incurred to promote vendors’ products are recorded as areductionof operating

and selling expenses in the period the expense is incurred.