OfficeMax 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

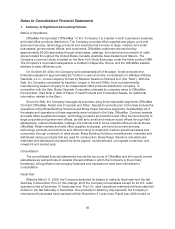

companies to apply a fair-value-based measurement method in accountingfor share-based payment

transactions with employees.

Effective January 1, 2006, we adopted SFAS No. 123R using the modified prospective transition

method. Accordingly, the financial statements for periods priorto January 1, 2006 have not been

restated to reflect the adoptionof SFAS No. 123R. Under the modified prospective transitionmethod,

we must record compensation expense for all awards granted after the adoption date and for the

unvested portionof previously granted awards that remain outstanding atthe adoption date, under

the fair value method. Previously, the Company recognized compensation expense forshare-based

awards to employees using the fair-value-based guidancein SFAS No. 123. Due to the fact that the

Company had previously accounted for share-based awards using SFAS No. 123, theadoptionof

SFAS No. 123R did not have a material impact on theCompany’s financial position, results of

operations or cash flows.

During 2006, the Company adopted SFAS No. 158, “Employer’s Accounting for DefinedPension

and Other PostretirementPlans—an amendment of FASB Statements No. 87, 88, 106and 132(R).”

This Standard requires that employersrecognize, on a prospective basis, thefunded status of their

defined benefit and postretirement benefit plans in the statement of financial position, and that

changes in the funded status be recognized as acomponent of other comprehensive income, net of

tax. SFAS No. 158 also requires the funded status of a plan to be measured a s of the date of the year-

end statement of financial position, and requires additional note disclosures. Therecognition and

disclosure guidance in SFAS No. 158 is effective as ofthe end of the first fiscal year ending after

December 15, 2006, and other measurement elements are effective for fiscal years ending after

December 15, 2008. The Company adopted the recognition provisions of SFAS No. 158 andinitially

applied themto the funded status ofits defined benefit pension and other postretirement benefit plans

as of December 31, 2006. The initial recognition of the funded status of our defined benefit pension

and other postretirement plans resulted in an increase inShareholders’ Equity of $11.9 million, which

wasnet of income taxes of $7.6 million. We currently measure the funded status of ourdefined benefit

plans as of the date of our fiscal year-end statement of financial position, and therefore, the adoption

of themeasurement provisions of SFAS No. 158 willhave no impact onour financial statements.

In June 2006, the FASB issued Interpretation (FIN) No. 48, “Accounting for Uncertainty in Income

Taxes—an interpretation of FASBStatement No. 109.” This Interpretationclarifies the accounting for

uncertainty in income taxes recognized in accordance with SFAS No. 109, “Accounting for Income

Taxes.” The Interpretation prescribes a recognition threshold and measurement attribute for the

financial statement recognition and measurement of a tax position taken or expected to be taken in a

tax return. It also provides guidance onderecognition, classification, interest and penalties,

accounting in interim periods, disclosureand transition. The Interpretation is effectivefor fiscal years

beginning after December 15,2006. TheCompany is in theprocess ofevaluating the impact of

applying the provisions ofthe Interpretation to all tax positions and currently anticipates the impact of

applying the interpretation will not be material.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements.” This Standard

defines fair value, establishes a framework for measuring fair value in generally accepted accounting

principles and expandsdisclosures about fair value measurements. SFAS No.157 is effective for

financial statements issued for fiscal years beginning after November 15, 2007, and interim periods

within those fiscal years. The adoptionof FAS 157 is not expected to have a material impact on the

Company’s financial position, results of operations or cash flows.

In September 2006, the Staff of the Securities and Exchange Commission issued Staff Accounting

Bulletin(SAB) No. 108, “Considering the Effects of a Prior Year Misstatements When Quantifying

Misstatements in CurrentYear Financial Statements.” SAB No. 108 addresses how the effects of prior

year uncorrected errors must be considered in quantifying misstatementsin current year financial