OfficeMax 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

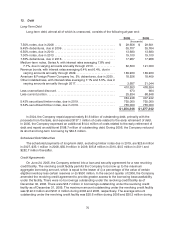

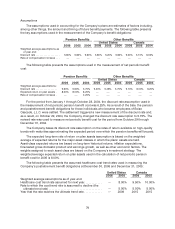

69

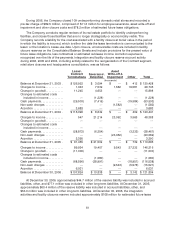

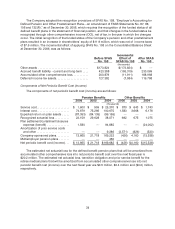

2005

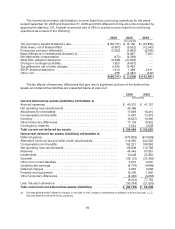

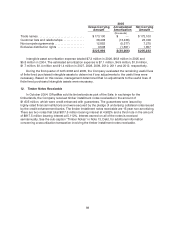

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

(thousands)

Trade names ............................... $173,100 $ — $ 173,100

Customer lists and relationships .............. 36,438 (13,438 )23,000

Noncompete agreements .................... 12,852 (5,577 ) 7,275

Exclusive distribution rights.................. 3,508(1,651) 1,857

$ 225,898$ ( 20,666) $205,232

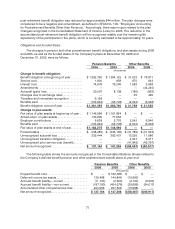

Intangible asset amortization expense totaled $7.3 millionin 2006,$6.8 million in 2005 and

$5.8 million in 2004. The estimated amortization expense is $7.1 million, $4.9 million, $1.8 million,

$1.7 million, $1.4million and $1.4 million in 2007, 2008, 2009, 2010, 2011and 2012, respectively.

During the first quarter of both 2006 and 2005, the Company evaluated theremaininguseful lives

of finite-lived purchased intangible assets to determine if any adjustments to the useful lives were

necessary. Based onthisreview, management determined that no adjustments to the useful lives of

finite-lived purchased intangible assets were necessary.

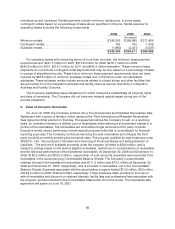

12. Timber Notes Receivable

In October 2004, OfficeMax sold its timberlands as part of the Sale. In exchange for the

timberlands, the Company received timberinstallment notes receivable in the amount of

$1,635 million, which were credit enhanced with guarantees. The guarantees were issued by

highly-rated financial institutions and were secured by the pledge of underlying collateral notes issued

by the credit enhancement banks. The timber installment notes receivable are 15-year non-amortizing.

There are twonotes that total $817.5 million bearing interest at 4.982% and a third note in the amount

of $817.5 million bearinginterest at 5.112%.Interest earned on all of the notes is received

semiannually. See the sub-caption “Timber Notes” in Note 13, Debt, for additional information

concerningasecuritization transaction involving the timber installmentnotes receivable.