OfficeMax 2006 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

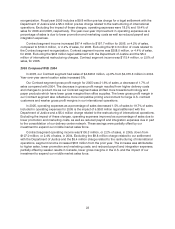

continuing involvement withBoise Cascade, L.L.C. We expect to recognize this gain as we reduce our

investment in affiliates of Boise Cascade, L.L.C.

During 2005 and 2004,we incurred costs related to the early retirementof debt of approximately

$14.4 million and $137.1 million, respectively.

Interest expense was $128.5 million and $151.9 million for the years ended December 31, 2005

and 2004, respectively. The decrease in interest expense was due to reduced debt levels in2005,

which were a result of debt repurchases and retirementsfunded with proceeds from the Sale. In 2005,

interest expense included interest related to the timber securitization notes of approximately $80.5

million. Theinterest expense associated with the timber securitization notes is offset by interest

income of approximately$82.5 million earned onthe timber notes receivable. The interest income on

the timber notes receivable is included in interest income and is not netted against the related interest

expense in ourConsolidated Statements of Income (Loss).

Excluding the interest income earned on the timber notes receivable, interest income was

$15.0 million in 2005 compared with $14.1 million in 2004. The increase in interest income is due to

the increase in cash and short-term investments following theSale.

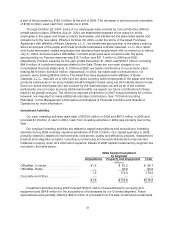

In 2005, we reported an income tax expense of $1.2 million on a pre-tax loss of $37.6 million. Our

effectivetax rate attributable to continuing operationsfor 2004 was37.5%.The difference betweenthe

statutory and the effective tax rates was due to the sensitivity of the rates tochanging income levels

and the mixofdomestic and foreignsources ofincome as well as the increase in the valuation

allowance for certain state net operating losses and the non-deductible nature of certain severance

costs and thelegal settlement recorded during 2005.

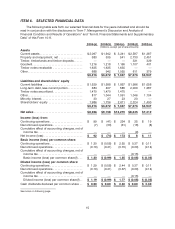

As a result ofthe foregoing factors, we reported a loss from continuing operations of $41.2

million, or $0.58 per diluted share, for2005, compared to income from continuing operations of

$234.1 million, or $2.44per diluted share, for 2004. Including theloss from discontinuedoperations,

the net loss for 2005 was $73.8 million, or $0.99 per diluted share, compared with net income of

$173.1 million, or $1.77 per diluted share in 2004. In 2005, net loss included a $28.2 million pre-tax

charge for the write-down of impaired assets at our Elma, Washingtonmanufacturing facility, which is

accounted for as a discontinued operation. In2004, netincome included a $67.8 million pre-tax charge

for the write-down of our Elma, Washington, manufacturing facility.

Excluding the charges for the write-down of impaired assets of certain retail stores, our legal

settlement with the Department of Justice, severance and professional fees, international restructuring

and our headquarters consolidation, we recognized income from continuing operations of $23.6

million, or $0.24 per diluted share, for 2005. Excluding the gain on the Sale, costs related to the early

repayment of debt and the gains on the sales of our interest in VoyageurPanel and timberland

property, income from continuing operations was $102.8 million, or $1.00 per diluted share, for 2004.

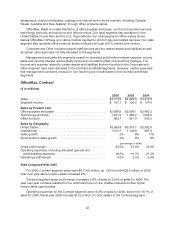

Segment Discussion

Effective with the first quarter of 2005, we began reporting our results using three reportable

segments: OfficeMax, Contract; OfficeMax,Retail; and Corporate and Other. The Boise Building

Solutions and Boise Paper Solutions segments include the results of our sold paper, forest products

and timberland assets prior to the Sale.

OfficeMax, Contract distributes a broad line of items for theoffice, including office supplies and

paper, technology products and solutions and office furniture.OfficeMax, Contract sells directly to

large corporate and government offices, as well as to small and medium-sized offices in the United

States, Canada, Australia and New Zealand. This segment markets and sells through field