OfficeMax 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

December 30, 2006, the facility closure reserve included approximately $108 million of estimated

future lease obligations,which is net of anticipated sublease income of approximately $109 million.

For each closed location, we estimatefuture sublease income based on current real estate trends by

market and location-specific factors, including the ageand quality of the location, as well as our

historical experience with similar locations. If we had used different assumptions to estimate future

sublease income our reserves would be different and the difference could be material. In addition, if

actual sublease incomeis different than our estimates, adjustments to the recorded reserves may be

required.

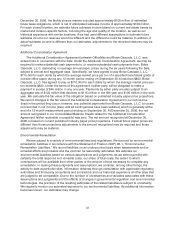

Additional Consideration Agreement

The Additional Consideration Agreement between OfficeMax and Boise Cascade, L.L.C. was

entered into in connection with the Sale. Under the Additional Consideration Agreement, we maybe

required to make substantial cash payments to, or receive substantial cash payments from, Boise

Cascade, L.L.C. depending on average annual paper prices during thesix years following theSale,

subject to annual and aggregate caps.Specifically, we have agreed to payBoise Cascade, L.L.C.

$710,000 for each dollar by which the average market price per ton of a specified benchmark grade of

cut-size office paper during any 12-month period ending on September 30 is less than $800. Boise

Cascade, L.L.C. has agreed to pay us$710,000 for each dollar by which the average market price per

tonexceeds $920. Under the terms ofthe agreement, neither party will be obligated to make a

payment in excess of $45 million in any one year. Payments by either party are also subject t o an

aggregate cap of $125 million that declines to $115 million in the fifth year and$105 million in the sixth

year. We calculate the fair value of the obligation based on published industry paper price projections.

We record changes in the fair value of the Additional Consideration Agreement in our net income

(loss) in the period they occur; however, any potential payments from Boise Cascade,L.L.C. to us are

not recorded in net income (loss) until all contingencies have been satisfied, which is generally at the

end ofa12-month measurement period ending on September 30. At December 30, 2006, the net

amount recognized inour Consolidated Balance Sheets related to the Additional Consideration

Agreement (eitherreceivable or payable) was zero. The net amount recognized at December 30,

2006,is based on current published industry paper price projections. If actual future paper prices are

different thanthose projections adjustments to the amount recognized may be required and those

adjustments may be material.

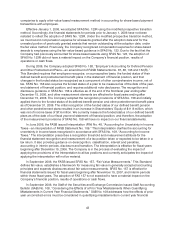

Environmental Remediation

We are subject to a variety of environmental laws and regulations. We account for environmental

remediation liabilities in accordance with the Statement ofPosition (SOP) 96-1, “Environmental

RemediationLiabilities.” We record liabilities on an undiscounted basis when assessments and/or

remedial efforts are probable and the cost can be reasonably estimated. We estimate our

environmental liabilities based on various assumptions and judgments,as we cannot predict with

certainty the total response and remedial costs, our share of total costs, the extent to which

contributions will be available from other parties or the amount of time necessary to complete any

remediation. In makingthese judgments and assumptions, we consider,among other things, the

activity to date at particularsites, information obtained through consultation with applicable regulatory

authorities and third-party consultants and contractors and our historical experience at other sites that

are judged to be comparable. Due to the number ofuncertaintiesand variables associated with these

assumptions and judgments and theeffects of changes in governmental regulationand environmental

technologies, the precision of the resulting estimates of the related liabilities is subject to uncertainty.

We regularlymonitor our estimated exposure to our environmental liabilities. As additional information

becomesknown,our estimates may change.