OfficeMax 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

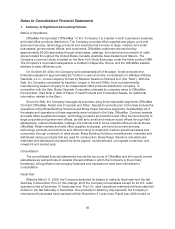

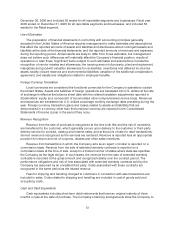

uncertainty in income taxes recognized in accordance with SFAS No. 109, “Accounting for Income

Taxes.” The Interpretation prescribes a recognition threshold and measurement attribute for the

financial statement recognition and measurement of a tax position taken or expected to be taken in a

tax return. It also provides guidance onderecognition, classification, interest and penalties,

accounting in interim periods, disclosureand transition. The Interpretation is effectivefor fiscal years

beginning after December 15,2006. TheCompany is in theprocess ofevaluating the impact of

applying the provisions ofthe Interpretation to all tax positions and currently anticipates the impact of

applying the interpretation will not be material.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements.” This Standard

defines fair value, establishes a framework for measuring fair value in generally accepted accounting

principles and expands disclosures about fair value measurements. SFAS No.157 is effective for

financial statements issued for fiscal years beginning after November 15, 2007, and interim periods

within those fiscal years. The adoptionof FAS 157 is not expected to have a material impact on the

Company’s financial position, results of operations or cash flows.

In September 2006, the Staff of the Securities and Exchange Commission issued Staff Accounting

Bulletin(SAB) No. 108, “Considering the Effects of a Prior Year Misstatements When Quantifying

Misstatements in CurrentYear Financial Statements.” SAB No. 1 08 addresses how the effects of prior

year uncorrected errors must be considered in quantifying misstatementsin current year financial

statements. For purposes of determining whether the financial statements are materially misstated, the

effects of prior yearuncorrected errors include the potential accumulation of improper amounts that

may result ina misstatement on the balance sheet or the reversal of prior period errors in the current

period that result in a misstatement of the current period income statement amounts. Adjustments to

current or prior period financial statements would be required in the event that a misstatement in

current period financial statements isdetermined to be material after consideration of all relevant

quantitative and qualitative factors. SAB No. 108 is applicable to all financial statements issued by the

Company after November 15, 2006. Its adoption in 2006 did not have an impact on our consolidated

financial statements.

In 2006, the Emerging Issues Task Force (EITF) reached aconsensus on Issue No. 06-03, “How

Sales Tax Collected from Customers and Remitted to Governmental Authorities Should be Presented

in the Income Statement(That is, Gross versusNe t Presentation).” This EITF Issue clarifies that the

presentationof taxes collected from customers and remitted to governmental authoritie s on a gross

(included in revenues and costs) or net (excluded from revenues) basis is an accounting policy

decision that should be disclosed pursuant to Accounting Principles Board (APB) Opinion No. 22,

“Disclosure of Accounting Policies.” The EITF Issue is effective for the Company beginning in fiscal

year 2007. We collect such taxes from ourcustomers and account for them on a net(excluded from

revenues) basis. The adoption of EITF Issue No. 06-03 will not impact our consolidated financial

statements, but will result in additional disclosures.

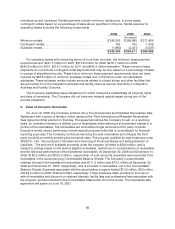

Reclassifications

Certain amounts included in the prior years’ financial statementshave been reclassified to

conform with the current year’s presentation. These reclassifications did not affect the reported

amounts of net income (loss) or earnings (loss) per share.

2. SaleofPaper, Forest Products and Timberland Assets

On October 29, 2004, the Company completed the Sale, which included substantially all ofthe

assets of the Boise Building Solutions and Boise Paper Solutions segments. In connection with the

Sale, the Company recognized a $280.6 million gain in the Consolidated Statement of Income (Loss).

For segment reporting purposes,the gain was included in theCorporate and Other segment.