OfficeMax 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

post-retirement benefit obligationwas reduced by approximately $44 million. The plan changes were

considered to be a negative plan amendment, as defined in SFAS No. 106, “Employers’ Accounting

for Postretirement Benefits Other than Pensions.” Accordingly, there was no gain related to the plan

changes recognized in the Consolidated Statement of Income (Loss) for 2005. The reduction inthe

accumulated post-retirement benefit obligation will be recognized ratably over the remaining life

expectancy ofthe participants in theplans, whichis currently estimated to be approximately 12 years.

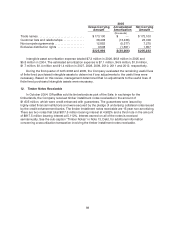

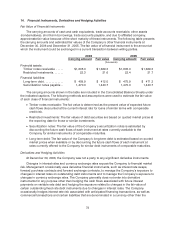

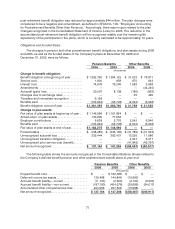

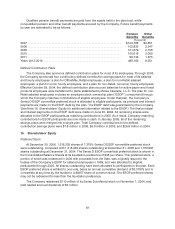

Obligations and Funded Status

The changes in pension and other postretirement benefit obligations and plan assets during2006

and 2005, as well as the funded status of the Company’s plans at December 30,2006 and

December 31,2005, were as follows:

Pension Benefits Other Benefits

2006 2005 2006 2005

(thousands)

Change in benefit obligation:

Benefit obligation at beginning of year........ $1,382,760 $1,394,125 $31,523 $78,871

Service cost ............................... 1,600959 870 643

Interest cost ............................... 74,679 75,266 1,583 3,668

Amendments .............................. — —— (44,240)

Actuarial (gain) loss........................ 20,007 8,138(180) (963)

Changes due to exchangerates ............. ——35 490

Transfers and immediaterecognition ......... 6,158—— —

Benefits paid .............................. (103,649) (95,728)(2,042) (6,946)

Benefit obligation at end of year.............. $ 1 ,381,555 $ 1 ,382,760 $ 31,789 $ 31,523

Change in plan assets:

Fair value of planassets at beginning of year .. $ 1,146,596$ 1,161,894 $ — $ —

Actual returnon plan assets ................. 130,690 77,654 — —

Employer contributions..................... 9,638 2,7762,042 6,946

Benefits paid .............................. (103,649) (95 ,728)(2,042) (6,946)

Fair value of planassets at end ofyear. ....... $ 1 ,183,275 $ 1 ,146,596 $ — $ —

Funded status ............................. $ (198,280) $ (236,165) $(31,789) $(31,523)

Unrecognized actuarialloss................. 335,444 383,431 10,220 11,086

Unrecognized transition obligation........... ——4,947 5,317

Unrecognized prior service cost (benefit). ..... ——(41,845) (45,797)

Net amount recognized ..................... $ 137,164 $ 147,266 $ (58,467) $(60,917)

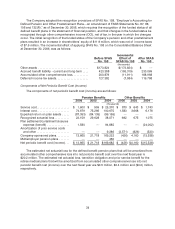

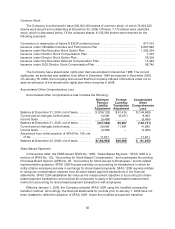

The following table shows the amounts recognized in the Consolidated Balance Sheets related to

theCompany’s defined benefit pension and other postretirement benefit plans at year end:

Pension Benefits Other Benefits

2006 2005 20062005

(thousands)

Prepaidbenefit cost ........................... $— $182,088 $— $ —

Deferred income taxassets. .................... 130,488 144,848 (10,690 ) —

Accrued benefitliability—current................(11,100) (2,600) (2,100) (6,900)

Accrued benefitliability—non-current ............(187,180) (404,578) (29,689 ) (54,017)

Accumulatedother comprehensive loss. .........204,956 227,508 (15,988 ) —

Net amount recognized........................ $ 137,164 $147,266 $(58,467 ) $(60,917)