OfficeMax 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

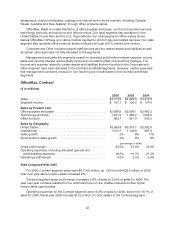

Corporate and Other

Corporate and Other expenses were $118.1 millionfor 2006. We recorded expenses largely

related to the headquarters consolidation in the Corporate andOther segment totaling$46.4 million

during 2006. Corporate and Other expenses were $118.5 million for 2005. During 2005 we recorded

$56.9 million of expenses in the Corporate and Other segment for headquarters consolidation, one-

time severance payments and other expenses, primarily professional service fees, which arenot

expected to be ongoing. Excluding the expenses related toheadquarters consolidation, one-time

severance payments and other expenses, the year-over-year increase in our Corporate and Other

expenses were primarily due to increased incentive compensation expense. In2004, ourCorporate

and Other segment realized income of $184.3 million, which included a $280.6 million gain from theSale

and $15.9 million of costs for one-time benefits granted to employees. Excluding these items, Corporate

and Other expenses were$80.4 million in 2004.

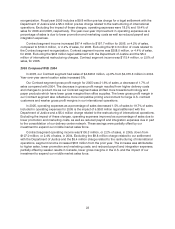

Boise Building Solutions

Operating Results

For the period from January 1to October 28, 2004, sales and operating income for Boise Building

Solutions was $3,257.7 millionand $319.2 million, respectively. On October 29, 2004, we completed

the Sale.

Boise Paper Solutions

Operating Results

For the period from January 1to October 28, 2004, sales and operating income for Boise Paper

Solutions was $1,670.4 millionand $38.8 million, respectively. OnOctober 29, 2004, we completed

the Sale.

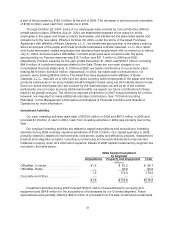

Sale of Paper, Forest Products and Timberland Assets

On October 29, 2004,we completed the sale ofour paper, forest productsand timberland assets

to affiliates ofBoise Cascade, L.L.C., a new company formed by Madison DearbornPartners LLC. The

assets that we sold were included in our Boise BuildingSolutions and Boise Paper Solutions

segments. TheSale completed the company’s transition, begun in themid-1990s,froma

predominantly manufacturing-based company to an independent officeproducts distribution

company. Some assets of the businesses we sold, such as the facility near Elma, Washington and

Company-owned life insurance, were retained by OfficeMax, as weresomeliabilities including those

associated with retiree pension and benefits, litigation and environmental remediation at selected sites

and facilities previously closed.

In connection with the Sale, we recorded a $280.6 million gain in ourCorporate and Other

segment. OnOctober 29, 2004, we invested $175 million insecurities ofaffiliates of Boise

Cascade, L.L.C.This investment represents continuing involvement as defined in Statement of

Financial Accounting Standards (“SFAS”) 144, “Accounting for the Impairment orDisposal of Long-

Lived Assets.” Accordingly, we do not show the historical results of the paper, forest products and

timberland assets as discontinued operations. An additional $180 million of gainonthe Sale was

deferred as a result ofour continuing involvement with Boise Cascade, L.L.C. We expect to recognize

this gain as we reduce our investment in affiliates of Boise Cascade, L.L.C.

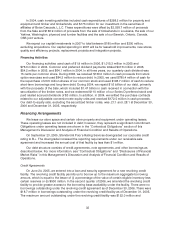

The considerationfor the timberlands portion of theSale included $1.6 billion of timber

installment notes. We monetized the timber installment notes in December 2004 for proceeds of

$1.5 billion. We realized net cash proceeds from the Sale of$3.3billion in 2004 after allowing for the