OfficeMax 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

In 2004, cash investing activities included cash expenditures of $298.2 million forproperty and

equipment andtimber and timberlands, and $175 million for our investment in the securities of

affiliates of Boise Cascade, L.L.C. These expenditures were offsetby $2,038.7 million of proceeds

from the Sale and $186.9 millionof proceeds from thesale of timberlands in Louisiana, the sale of our

Yakima, Washington, plywood and lumber facilities and the sale of our Barwick, Ontario, Canada,

OSB joint venture.

We expect our capital investments in2007 to total between $180 million and $200 million,

excluding acquisitions. Our capital spending in 2007 will be for leasehold improvements,new stores,

quality and efficiency projects, replacement projects and integrationprojects.

Financing Activities

Our financing activities used cash of $1.9million in 2006, $1,015.3 million in 2005 and

$76.3 million in 2004. Common and preferred dividend payments totaled $47.6million in 2006,

$54.2 million in 2005, and $64.1 million in 2004. In all three years, our quarterly cash dividend was

15 cents per commonshare. During 2006, we received $130.0 million in cash proceeds from stock

option exercises and used $84.3 million to reduce debt. In 2005, we used $780.4 million of cash for

the repurchase of 23.5 million shares of our common stock and used $198.7 million of cash to reduce

short-term borrowings and long-term debt. During 2004, we repaid $1.6 billion ofour debt, primarily

with the proceeds of the Sale, which included $1.47 billion in cash received inconnection with the

securitization ofthe timbernotes, and we redeemed $110 million of our Series D preferred stock and

paid related accrued dividends of $3 million. In addition, in 2004, we settled the purchase contracts

related to our adjustable conversion-rate equity units and received $172.5 million incash proceeds.

Our debt-to-equityratio, excludingthe securitized timber notes,was .21:1 and .28:1 at December 30,

2006 and December 31, 2005, respectively.

Financing Arrangements

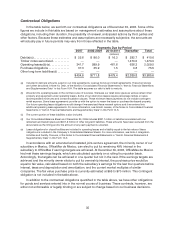

We lease our store space and certain other property and equipment under operating leases.

Theseoperating leases are not included in debt; however, theyrepresent a significant commitment.

Obligations under operating leases are shown in the “Contractual Obligations” section ofthis

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

On September 23, 2005,Standard & Poor’s Rating Services downgraded ourcorporate credit

rating to B+. The downgrade increased the reporting requirements under our receivable sale

agreementand increased the annual cost of thatfacility byless than $1 million.

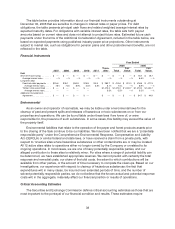

Our debt structure consists of credit agreements, note agreements, and other borrowingsas

described below. For more information, see “Contractual Obligations” and “Disclosures of Financial

Market Risks” in this Management’s Discussion and Analysis of Financial Condition and Results of

Operations.

Credit Agreements

On June 24, 2005,weentered into a loan and security agreementfor anew revolving credit

facility. The revolvingcredit facility permits us to borrow up to the maximum aggregate borrowing

amount, which is equal to the lesser of (i) a percentage of the value ofcertain eligible inventory less

certain reserves or (ii)$500million. In the second quarter of 2006, we amended the revolving credit

facility to provide greater access to the borrowing base availability under the facility. There were no

borrowings outstanding under the revolving credit agreement as of December 30, 2006. There were

$18.7 million in borrowings outstanding under the revolving credit facility as ofDecember 31,2005.

The maximum amount outstanding under the revolving credit facility was $122.0 million and