OfficeMax 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

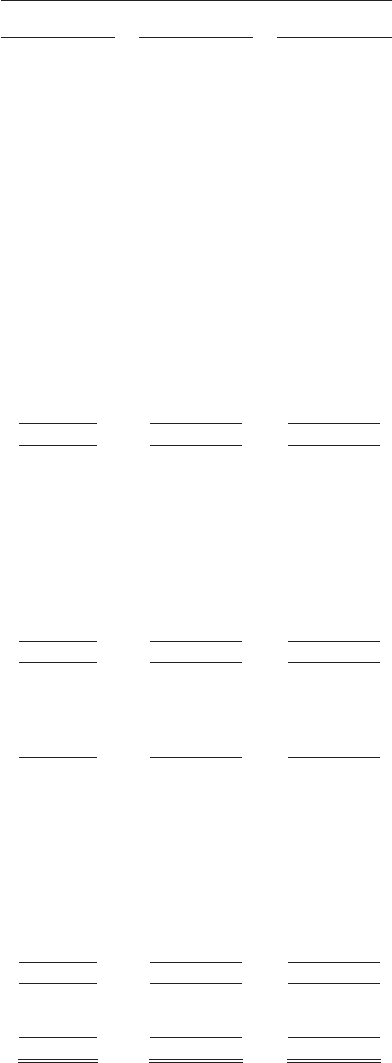

See accompanying notes to consolidated financial statements.

48

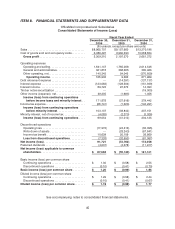

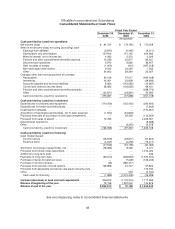

OfficeMax Incorporated and Subsidiaries

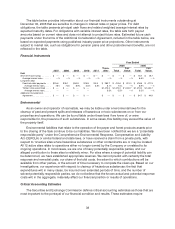

Consolidated Statements of Cash Flows

FiscalYear Ended

December 30,

2006

December 31,

2005

December 31,

2004

(thousands)

Cash provided by (used for) operations:

Net income(loss)........................................ $91,721 $(73,762 ) $ 173,058

Items in net income (loss) not using (providing) cash

Earnings fromaffiliates.................................. (5,873)(5,460) (6,311)

Depreciation and amortization............................ 127,812151,145 354,982

Minority interest, net of incometax......................... 4,083 2,370 3,026

Pension and other p ostretirement benefits expense ........... 13,239 25,877 83,261

Discontinued operations ................................. 5,973 8,862 36,457

Gain on sales of assets. ................................. (1,004)(410) (387,218)

Non-cash asset write-downs.............................. 9,543 23,062 1,582

Other ................................................ 24,602 38,384 22,027

Changes other thanfrom acquisition of business

Receivables ........................................... 29,126 47,517(

490,168)

Inventories............................................ 43,001 32,809(

39,630)

Accountspayable and accrued liabilities. ................... 8,662 (142,582) (15,867)

Currentand deferred income taxes........................ 58,683 (136,629) 69,431

Pensionand other postretirement benefits payments.......... ——(288,772)

Other ................................................ (33,871) (28,881) 32,993

Cash providedby (usedfor) operations. .................... 375,697(57,698) (451,149)

Cash provided by (used for) investment:

Expenditures for property andequipment ..................... (174,769) (152,450) (290,600)

Expenditures for timber andtimberlands. ..................... ——(7,642)

Investments inaffiliates.................................... ——

(174,901)

Acquisitionof businesses and facilities, net of cash acquired ..... (1,500)(34,803) —

Proceeds fromsaleof (purchase of) restricted investments ....... —93,259 (113,000)

Proceeds from sales of assets .............................. 12,333 —2

,225,561

Discontinued operations ................................... ——(

9,388)

Other.................................................. —(3,343) 15,078

Cash providedby (usedfor) investment .................... (163,936) (97,337) 1,645,108

Cash provided by (used for) financing:

Cash dividends paid

Common stock ........................................ (43,509) (49,817) (51,874)

Preferred stock ........................................ (4,037)(4,379) (12,211)

(47,546) (54,196 ) (64,085)

Short-term borrowings (repayments), net ..................... (18,666) 8,266 5,121

Proceeds from timber notessecuritized. ...................... ——1,470,000

Additionsto long-term debt................................ ——246

Payments of long-term debt ................................ (65,610) (206,933) (1,570,504)

Purchase of Series D preferred stock. ........................ —(7,229) (123,233)

Purchase of common shares ............................... (33) (780,417) —

Proceeds from exercise of stock options...................... 129,96624,747 37,823

Proceeds fromadjustableconversion-rate equity securityunits.... ——172,500

Other.................................................. —453 (4,164)

Cash used forfinancing ................................. (1,889)(1,015,309) (76,296)

Increase(decrease) in cash and cash equivalents............ 209,872(1,170,344) 1,117,663

Balanceat beginning of the year........................... 72,198 1,242,542124,879

Balanceatend of the year ................................ $ 282,070$ 72,198$ 1,242,542