OfficeMax 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

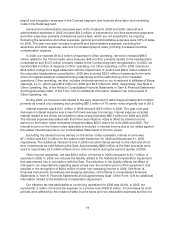

2005 Compared With 2004

In 2005, Retail segment sales were $4,529.1 million, up 1.1% from sales of $4,481.3 millionfor

2004. During 2005,Retail segment sales decreased 1.0% year-over-year on asame-location basis.

Retail segment sales in 2005 benefited from a 53rd week,which increased sales by approximately

$75 million. Excluding this impact, Retail segmentsales decreased as a result of reduced promotional

activity and advertising placements, primarily during the first half of 2005, a strategy used to reduce

costs and shift marketingfocus toward oursmall business customer, partially offset by an increase in

the average dollar amount per customer transaction. During 2005, our Retail segment opened 33

stores in the U.S.and 6 stores in Mexico and closed 9 storesin the U.S.

Our Retailsegment gross profit marginfor 2005 was 26.2% of sales, compared to 25.6% of sales

in 2004. The increase in gross profitmarginwas primarily due to a shift in mix to higher margin

products and services, a direct result of our new promotional and advertising strategy.

Retail segment operatingexpenseswere 25.6% of sales in 2005 compared to25.1% in2004. In

2005,werecorded $17.9 millionin asset impairment charges primarily related to the retail store

closures. Excluding thesecharges, operating expenses were 25.2% ofsales in2005.

For 2005, the Retail segment had operating income of $27.9 million, compared to $22.7 million in

2004.Operating margin forour Retail segment was 0.6% of sales in 2005, compared with 0.5% of

sales in 2004. In 2005, we recorded $17.9 millionin asset impairment charges primarily related to the

retail store closures. Excluding these charges, operating margin in 2005 was 1.0% of sales. This

increase in operating margin is a result of increased sales due to the additional selling week and

improved gross profit margindue to a shift inmix tohigher margin products and services.