OfficeMax 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

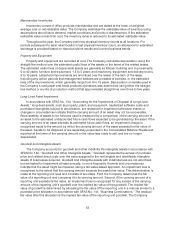

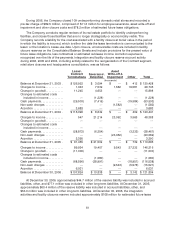

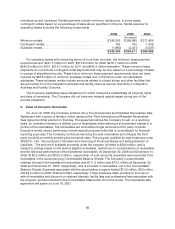

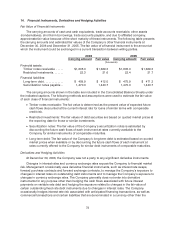

6. Other Operating,Net

The componentsof other operating, netinthe Consolidated Statements of Income(Loss) are as

follows:

2006 2005 2004

(thousands)

Gain on sale of interest in VoyageurPanel (Note 10).......... $—$— $ (46,498)

Gain on sale of Louisianatimberlands(a) .................... —— (59,915)

Gains on sales of other timberlands........................ —— (15,059)

Gain on sale of forestproductsassets (Note2).............. —— (280,558)

Integration activities and facility closure costs (Note 4)........ 146,216 48,178 8,936

Loss on saleand write-down of Yakima assets(b)............ —— 7,123

Costs incidental to the Sale (Note 2)........................ —— 18,916

Legal settlement(c)....................................... —9,800 —

Other, net ............................................... —1,527 2,757

Earnings fromaffiliates. ................................... (5,873) (5,460 ) (6,311)

$ 1 40,343 $54,045 $ ( 370,609)

(a) In March 2004, the Company sold approximately 79,000 acres of timberland in western Louisiana for $84 million in cash

and recognized a $59.9 million pre-tax gain in the ConsolidatedStatement of Income (Loss) for 2004.

(b) In February 2004, the Company completed the sale of its plywood and lumber facilities in Yakima, Washington. In

connection with the sale, the Company recorded $7.1 million of costs in other operating, net in the Consolidated

Statement of Income for 2004. The sale also resulted in a $7.4 million reduction in the LIFO inventory reserve, the effect of

which was reflected in cost of goods sold and occupancycosts in 2004.

(c) Legal settlement with the Department ofJustice.

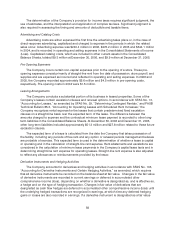

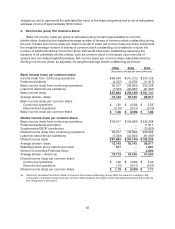

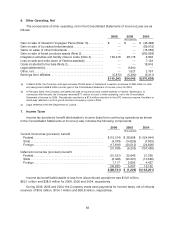

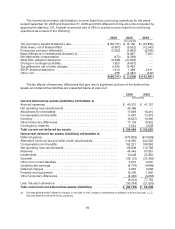

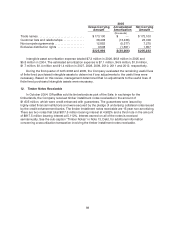

7. Income Taxes

Income tax (provision) benefit attributable to income(loss)from continuingoperations as shown

in the Consolidated Statements ofIncome (Loss) includes the following components:

2006 2005 2004

(thousands)

Current income tax (provision) benefit

Federal............................................... $(10,014) $ 28,908 $(124,944)

State ................................................. (4,079) (14,629) (7,933)

Foreign............................................... (17,816) (20,512) (24,606)

(31,909) (6,233) (157,483)

Deferred income tax(provision) benefit

Federal............................................... (31,521) 22,646 21,350

State ................................................. (6,428) (23,331) (10,595)

Foreign............................................... 1,117 5,692 4,437

(36,832) 5,007 15,192

$ ( 68,741) $ (1,226) $(142,291)

Income tax benefit attributable to loss from discontinued operations was $10.6 million,

$20.1 million and $38.9 million for 2006, 2005 and 2004, respectively.

During 2006, 2005and 2004, the Company made cash payments for income taxes, net of refunds

received, of $0.6 million, $134.1 million and $36.6 million, respectively.