OfficeMax 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

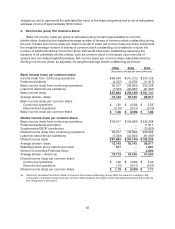

64

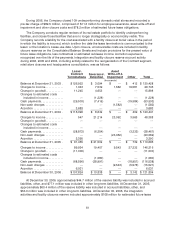

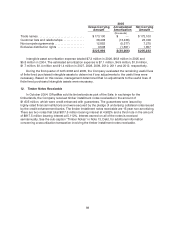

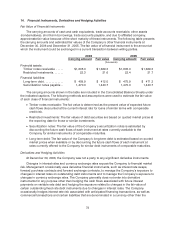

The income tax provision attributable toincome(loss)from continuing operations for the years

ended December 30, 2006 and December 31, 2005 and 2004 differed from the amounts computed by

applying the statutory U.S. Federal income tax rate of 35% to pre-tax income (loss) from continuing

operations as a result of the following:

2006 2005 2004

(thousands)

Tax(provision) benefit at statutory rate...................... $(60,157) $ 13,166 $(132,805)

State taxes, net of federal effect ............................ (5,907)(5,532) (12,043)

Foreign taxprovision differential........................... (5,262)(2,883) (6,905)

Basis difference ininvestments disposed of ................. —14,867 7,000

Nondeductible compensation............................. (473) (4,268) —

State NOL valuation allowance. ............................ (6,498)(21,533) —

Change in contingency liability. ............................ 1,925(4,607) —

Tax settlement, net of other charges........................ 5,24012,462 —

ESOP dividenddeduction ................................. 1,4131,489 2,911

Other, net ............................................... 978 (4,387) (449)

$ ( 68,741) $ (1,226) $(142,291)

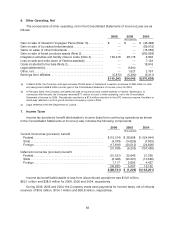

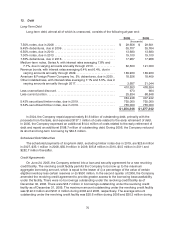

The tax effects of temporary differences that give rise to significant portions of the deferred tax

assets and deferred tax liabilities are presented below at year end:

2006 2005

(thousands)

Current deferred tax assets (liabilities) attributable to

Accrued expenses ................................................. $40,231 $ 41,157

Net operating loss carryforwards..................................... 43,489 —

Allowances for receivables.......................................... 17,998 18,410

Compensation and benefits ......................................... 11,657 13,473

Inventory......................................................... (6,047) 10,290

Other temporarydifferences ......................................... 17,124 19,922

Contingency reserves .............................................. 5,0 44 2,568

Total current net deferred tax assets................................ $ 129,496 $105,820

Noncurrent deferredtax assets (liabilities) attributable to

Deferred gain(a) ................................................... (473,838) (473,838)

Alternativeminimum tax and other credit carryforwards ................. 214,590 234,222

Compensation and benefits ......................................... 152,221 158,853

Net operating loss carryforwards..................................... 66,849 110,788

Reserves.......................................................... 44,445 57,851

Investments ....................................................... 10,046 22,852

Goodwill.......................................................... (33,110) (31,060)

Other non-currentliabilities .......................................... 3,010 2,091

Undistributed earnings. ............................................. (4,776) (4,689)

Deferred charges .................................................. 2,692 3,056

Property andequipment ............................................ 14,300 1,890

Other temporarydifferences ......................................... (4,430) (4,253)

(8,001) 77,763

Less: Valuation allowance........................................... (30,734) (21,533)

Total noncurrent net deferred tax assets (liabilities).................. $ (38,735 ) $ 56,230

(a) Includes $543.8 million related to the gain on the sale of the Company’s timberlands to affiliates of Boise Cascade, L.L.C.

that was deferred until2019 for tax purposes.