OfficeMax 2006 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

Stock Options

In addition to the2003 DSCP andthe 2003 Plan discussed above, the Company has the following

shareholder-approved stock option plans: theKey Executive Stock Option Plan(“KESOP”), the

Director Stock OptionPlan (“DSOP”) and the Director Stock Compensation Plan (“DSCP”).Nofurther

grants will be made under the KESOP, DSOP and DSCP.

The KESOP provided for the grant ofoptions to purchase shares of commonstock to key

employees of theCompany.The exercise price of awards under the KESOP was equal to the fair

market value of the Company’s common stock on the datethe options were granted. Options granted

under the KESOP expire, at the latest, ten years and one day following the grant date.

The DSOP, which was available only to nonemployee directors, provided for annual grantsof

options. The exerciseprice of awards under the DSOP was equaltothe fair market value of the

Company’s common stock on thedate the options were granted. The options granted under the

DSOP expire upon the earlier ofthree years after the director ceases to be a director or ten years after

the grant date.

The DSCP permitted nonemployee directors to elect to receive grants of options to purchase

shares of the Company’s common stock in lieu ofcash compensation. The difference between the

$2.50-per-share exercise price of DSCP options and the market value of the common stock subject to

the options was intendedto offset the cash compensationthat participating directors elected not to

receive. Optionsgranted under the DSCP expire three years after the holder ceases to be a director.

Under the KESOP and DSOP, options may not, except under unusual circumstances, be

exercised until one year following the grant date. Under the DSCP, options may be exercised six

months after the grant date.

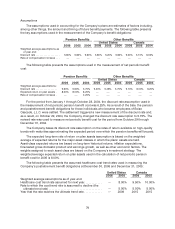

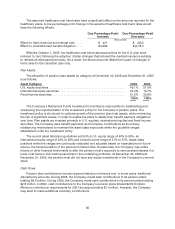

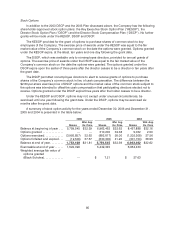

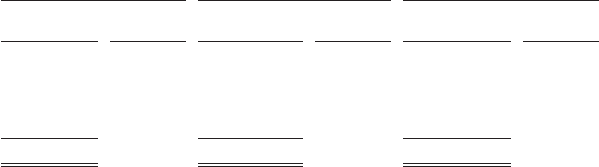

A summaryof stock option activity for theyears ended December 30, 2006 and December 31,

2005 and 2004 is presented in the table below:

2006 2005 2004

Shares

Wtd. Avg.

Ex. Price Shares

Wtd. Avg.

Ex. Price Shares

Wtd. Avg.

Ex. Price

Balance at beginning of year... 5,759,545$ 3 2.39 6,963,462 $ 32.628,457,888 $ 32.16

Options granted .............. — —310,200 32.389,032 2.50

Options exercised............. (3,993,857) 32.62(883,817) 28.00(1,202,308) 27.56

Options forfeited and expired ... (12,500)37.57 (630,300) 41.20(301,150) 38.95

Balance at endofyear......... 1,753,188 $ 3 1.81 5,759,545 $ 3 2.39 6,963,462 $ 32.62

Exercisable at end of year ...... 1,522,3905,449,345 6,954,430

Weighted average fair value of

options granted

(Black-Scholes)............. — $ 7.21 $ 27.63