OfficeMax 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.44

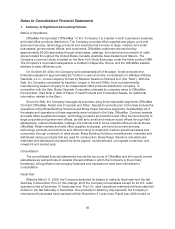

statements. For purposes of determining whether the financial statements are materially misstated, the

effects of prior yearuncorrected errors include the potential accumulation of improper amounts that

may result ina misstatement on the balance sheet or the reversal of prior period errors in the current

period that result in a misstatement of the current period income statement amounts. Adjustments to

current or prior period financial statements would be required in the event that a misst atement in

current period financial statements isdetermined to be material after consideration of all relevant

quantitative and qualitative factors. SAB No. 108 is applicable to all financial statements issued by the

Company after November 15, 2006. Its adoption in 2006 did not have an impact on ourconsolidated

financial statements.

In 2006, the Emerging Issues Task Force (EITF) reached aconsensus on Issue No. 06-03, “How

Sales Tax Collected from Customers and Remitted to Governmental Authorities Should be Presented

in the Income Statement(That is, Gross versusNet Presentation)”. This EITFIssue clarifies that the

presentationof taxes collected from customers and remitted to governmental authorities on a gross

(included in revenues and costs) or net (excluded from revenues) basis is an accounting policy

decision that should be disclosed pursuant to Accounting Principles Board (APB) Opinion No. 22,

“Disclosure of Accounting Policies.” The EITF Issue is effective for the Company beginning in fiscal

year 2007. We collect such taxes from ourcustomers and account for them on a net(excluded from

revenues) basis. The adoption of EITF Issue No. 06-03 will not impact our consolidated financial

statements, but will result in additional disclosures.

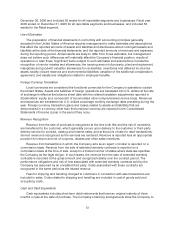

ITEM 7A.QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET

RISK

Information concerning quantitative and qualitative disclosures aboutmarketrisk is included

under the caption “Disclosures of Financial Market Risks” in “Item 7. Management’s Discussionand

Analysis of Financial Condition and Results ofOperations” in this Form 10-K.