OfficeMax 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

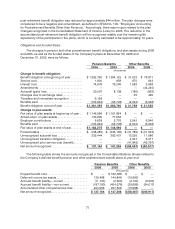

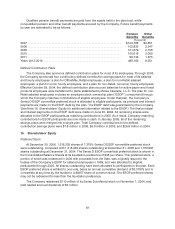

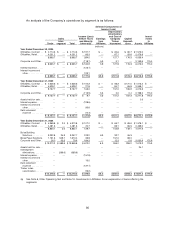

The following table provides summarized information aboutstock options outstanding at

December 30,2006:

Options Outstanding Options Exercisable

Range of Exercise Prices

Options

Outstanding

Weighted

Average

Contractual

Life (Years)

Weighted

Average

Exercise

Price

Options

Exercisable

Weighted

Average

Exercise

Price

$2.50. ................... 12,724 —$2.50 12,724 $ 2.50

$18.00 — $28.00.......... 615,0043.6 27.62615,004 27.62

$28.01 — $39.00.......... 1,125,4604.5 34.43894,66234.95

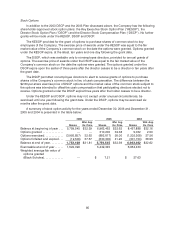

The remaining compensation expense to be recognized related to outstanding stock options, net

of estimated forfeitures, is approximately $0.8 million. At December 30, 2006, the aggregate intrinsic

value ofoutstanding stock options was $31.3 million and forexercisable stock options was $27.3

million. The aggregate intrinsicvalue represents the total pre-tax intrinsic value(i.e. the difference

between the Company’s closing stock price on the last trading day of the fourth quarter of 2006 and

the exercise price,multiplied bythe number of in-the-money optionsat the end of the quarter).

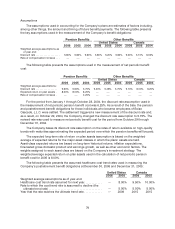

The Company did not grant any stock options in2006. To calculate stock-based employee

compensation expense under the fair value method as outlined in SFAS 123 in 2005 and 2004, the

Company estimated the fair value of each option award on the date ofgrant using the Black-Scholes

optionpricing model with the following weighted-average assumptions: risk-free interest rates of4.3%

in 2005 and 3.6% in 2004 (based on theapplicable Treasury bill rate); expected dividends of 60 cents

per share inboth years (based on actual cash dividends expected to be paid); expected life of 3.4

years in 2005 and 4.3 years in2004(based on the time period options are expected to be outstanding

based on historical experience); and expected stock price volatility of 28% in 2005 and 40% in2004

(based onthe historical volatility ofthe Company’s common stock).

Other

In May 2005, the Company repurchased 23.5 million shares of its common stock and the

associated common stock purchase rights through a modified Dutch auction tender offer at a

purchaseprice of $775.5 million, or $33.00 per share, plus transaction costs.

In September 1995, the Company’s Board of Directors authorized the purchase of up to

4.3 million shares of theCompany’s common stock. As part of this authorization, the Company

repurchased odd-lot shares (fewer than 100 shares) from shareholders wishing to exit their holdings in

the Company’s common stock. Shares repurchased under this program are retired. Since 1995,the

Company has repurchased 50,577shares of common stock under this authorization, including 907

shares in 2006 and 2,190 shares in 2005. The Company’s Board ofDirectors terminated the share

repurchase authorization in December 2006.

17. SegmentInformation

The Company manages its business using three reportable segments: OfficeMax, Contract;

OfficeMax, Retail; and Corporate and Other. Results for periods prior to the sale include the

operations of the Boise Building Solutions andBoise Paper Solutions segments. Substantially all of

the assets and operations of these segmentswere included in the Sale. Each of the Company’s

segments represents a business withdiffering products, services and/or distribution channels. Each of

these segments requires distinctoperating and marketing strategies. Management reviews the

performance of the Company based on these segments.