OfficeMax 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.74

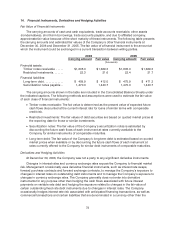

currency of the operating unit entering into the underlying transaction. The Company does not

speculate using derivative instruments.

The derivative financial instruments that the Company usesin itsmanagementofinterest rate risk

consist principally of interest rate swap agreements. By using derivativefinancial instruments to hedge

exposures tochanges in interest rates, the Company exposes itself to credit risk and marketrisk.

Credit risk is the risk that the counterparty will fail to perform under the terms ofthe derivative contract.

The Company attempts to minimize the credit risk inderivative instruments by entering into

transactions only with investment grade counterparties. Market risk is the adverse effect on the value

of a financial instrument that results from achange in interest rates. The market risk associated with

interest rate contracts is managedby establishing and monitoring parameters that limit the types and

degree ofmarket risk that may be undertaken.

The Company assesses its exposure to variability in interest rates by continually identifying and

monitoring changes in interest rates that may adversely impact future cash flows and the fair value of

existing debt instruments, and byevaluating hedging opportunities. TheCompany maintains risk

management control systems to monitor interest rate risk attributable to both theCompany’s

outstanding and forecasted debtobligations as well as the Company’s offsetting hedgepositions. The

risk management control systems involve the use of analytical techniques, including sensitivity

analysis, to estimate the expected impact of changes in interest rates onthe fair value of the

Company’s outstanding and forecasted debt instruments.

The Company usesacombination offixed and variable rate debt to finance its operations. The

debt obligations with fixed cashflows exposethe Company to variability inthe fair value of

outstanding debt instruments due tochanges in interest rates. The Company has from time to time

entered into interest rate swap agreements that effectively convert the interest rate oncertain fixed-

rate debt to avariable rate. TheCompanyhas designated these interest rateswap agreements as

hedges ofthe changes in fair value of the underlying debt obligati on attributable to changes in interest

rates and accounted for them as fair value hedges. Changes in the fair value of interest rate swaps

designated ashedging instruments that effectively offsetthe variability in the fair value of outstanding

debt obligations are reported in operations. These amounts offset the gain or loss (that is, the change

in fair value) of the hedged debt instrument that is attributable to changes in interest rates(that is, the

hedged risk) which is also recognized currently inoperations.The Company has also from time to

time entered into interest rate swap agreements that effectivelyconvert floating rate debt to a fixed

rate obligation. These swaps have been designated as hedges of floating interest rate payments

attributable to changes in interest ratesand accounted for as cash flow hedges,withchanges in the

fair value of the swap recorded to other comprehensive income (loss) until the hedged transaction

occurs, at which time it is reclassified to operations.

Prior to the Sale, the Company had a commodity-price risk management strategy that used

derivative instruments to minimize significant, unanticipated earnings fluctuations caused by energy

price volatility. The activities of theCompany’s paper, forest products and building materials

businesses required a significant volume of electricity and natural gas. Price fluctuationsinelectricity

and natural gas couldcause the actual purchase prices paid for energy to differ from anticipated

prices.

Unrealized gains and losses associated withmarking the electricity and natural gas swap

contracts tomarket were recorded as acomponent of other comprehensive income(loss) and

included inthe stockholders’ equity section of the Consolidated Balance Sheets as part of

accumulated other comprehensive income (loss).These amounts were reclassified into operations in

the month in which the related electricity or natural gas was used or in the month a hedge was

determined to be ineffective.