OfficeMax 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.75

Interest Rate Swaps

On October 27, 2004, the Company and one ofits subsidiaries each entered into an interest rate

swap contract with an affiliate of Goldman,Sachs &Co. The contracts were entered into in order to

hedge the interest rate risk associated with the issuance of debt securitiesin connection with the

securitization of the timber notes received in theSale. (See Note13 Debt, for additional information

related tothe timber notes and the related securitization transaction.) The Company paid $19.0 million

to settle these swap contracts on December 16, 2004, in conjunction with the issuance of the

securitization notes. Thesettlement amount reflected the effect of the decrease in interest rates that

occurred during the period the swaps were outstanding.

In April and May 2004, the Company entered into two interest rate swaps withnotional amounts

of $50 million each. These swaps converted $100 million of fixed-rate 7.50% debentures tovariable-

rate debt based on six-month LIBOR plus approximately 3.9% for the April swap, andsix-month

LIBOR plus3.8% for the May swap. In March 2002, the Company entered into aninterest rate swap

with a notional amount of $50million. This swap converted $50 million of fixed-rate 7.05% debentures

to variable-rate debt based on six-month LIBOR plus approximately 2.2%. In September 2004, the

Company settled all of theseswaps inanticipation of making atender offer for the underlying debt

instruments. These swaps were designated as fair value hedges of a proportionate amount of the

fixed-rate debentures. The swaps and debentures were marked to market, with changes in the fair

value of the instruments recorded in income (loss) in the period they arose. These swaps were

effective inhedging the changes in the fair value of the hedge d item; accordingly,changes in thefair

values of these instruments had no neteffect onreported net income (loss).

In February 2001, the Company entered into two interest rate swaps with notionalamounts of

$50 million each, one that matured in February 2003 and one thatmatured in February 2004. In

November 2001, the Company entered into a third interest rate swapwithanotional amount of

$50 million, which matured inNovember 2004. The swaps were designated as hedgesof the variable

cash flow risk related to the variable interest payments on equivalent amo unts of LIBOR-based

revolving credit borrowings outstanding in 2004 and 2003.Changes in the fair value of these swaps,

net of taxes, were recorded inaccumulated othercomprehensive income (loss) and reclassified to

interest expense as interest expense was recognized on the LIBOR-based debt. Amounts reclassified

to operations in 2004 increased interest expense by $1.2 million. Ineffectiveness related to these

hedges was not significant.

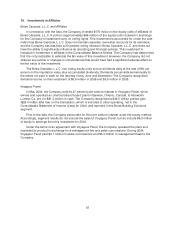

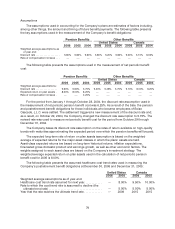

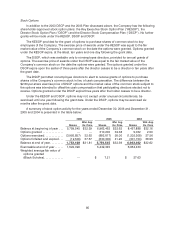

Additional Consideration Agreement

Pursuant to an Additional Consideration Agreement between OfficeMax and Boise Cascade,

L.L.C., wemay be required to make substantial cashpayments to, or receive substantial cash

payments from, Boise Cascade, L.L.C. Under the Additional ConsiderationAgreement, the Sale

proceeds may be adjusted upward or downward based on paper prices during the six yearsfollowing

the Sale, subject to annual and aggregate caps. Specifically, we have agreed to pay Boise Cascade,

L.L.C. $710,000 for each dollar by which the averagemarket priceper ton ofa specified benchmark

grade of cut-size office paper during any 12-month period ending on September 30 is less than$800.

Boise Cascade, L.L.C. has agreed to pay us $710,000 for each dollar by which the averagemarket

price per ton exceeds $920. Under the terms of the agreement, neither party will be obligated to make

a payment inexcess of$45 million in any one year.Payments by either party are also subject to an

aggregate cap of $125 million that declines to $115 million in the fifth year and$105 million inthe sixth

year.

In connection with recording the Sale in 2004, we calculated our projected future obligation under

the Additional Consideration Agreement and accrued $42million in Other long-term liabilities on our

Consolidated BalanceSheet. Wecalculated the$42 million based on published industry paper price