OfficeMax 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

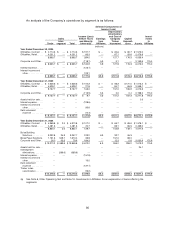

82

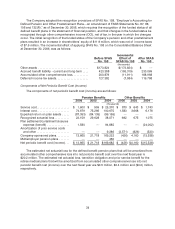

Common Stock

The Company is authorized to issue 200,000,000 shares ofcommon stock, of which 74,903,220

shares were issued and outstanding at December 30, 2006. Of these, 7,170 shares were restricted

stock, which isdiscussed below. Of the unissuedshares, 8,133,246 shares were reserved for the

following purposes:

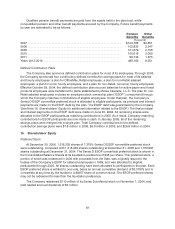

Conversion or redemption of Series DESOP preferred stock........................977,410

Issuance under OfficeMax Incentive and PerformancePlan..........................5,657,893

Issuance under Key ExecutiveStock Option Plan ..................................1,382,264

Issuance under Director Stock Compensation Plan.................................7,475

Issuance under Director Stock Option Plan........................................36,000

Issuance under KeyExecutive Deferred Compensation Plan.........................13,464

Issuance under 2003 Director Stock Compensation Plan ............................ 58,740

The Company has a shareholder rights plan thatwas adopted in December 1988. The current

rights plan, as amended and restated, took effect in December 1998 and expires in December 2008.

On January 18, 2006, the Company announced that the Company’s Board of Directors voted not to

seek anextension of the shareholder rights plan when it expires in 2008.

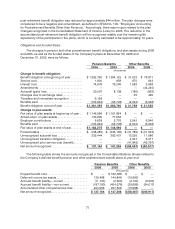

Accumulated Other Comprehensive Loss

Accumulated other comprehensive loss includes thefollowing:

Minimum

Pension

Liability

Adjustment

Foreign

Currency

Translation

Adjustment

Accumulated

Other

Comprehensive

Loss

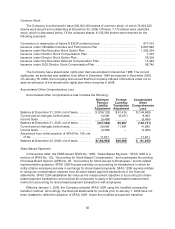

Balance atDecember31, 2004, net of taxes ......... $(236,123) $91,424$(144,699)

Current-period changes,before taxes. .............. 14,099 (6,037) 8,062

Income taxes .................................... (5,484)— (5,484)

Balance atDecember31, 2005, net of taxes ......... (227,508)85,387 (142,121)

Current-period changes,before taxes. .............. 29,999 11,581 41,580

Income taxes .................................... (3,365)— (3,365)

Adjustment from initial adoptionof SFAS No. 158, net

of tax ......................................... 11,911 —11,911

Balance atDecember30, 2006, net of taxes ......... $ (188,963)$ 9 6,968 $(91,995)

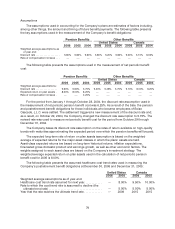

Share-Based Payments

In December 2004, the FASB issued SFAS No. 123R,“Share Based Payment.” SFAS 123R is a

revisionof SFAS No. 123, “Accounting for Stock-Based Compensation,” and supersedes Accounting

PrinciplesBoard Opinion (APB) No. 25, “Accountingfor Stock Issued to Employees,” and its related

implementation guidance. SFAS 123R focuses primarily onaccounting for transactions in which an

entity obtains employee services in exchange for share-based payments. SFAS 123R requires entities

to recognize compensation expense from all share-based payment transactions inthe financial

statements. SFAS 123R establishes fair value as the measurement objective in accounting for share-

based payment transactions and requires all companies to apply a fair-value-based measurement

method in accounting for share-based payment transactions with employees.

Effective January 1, 2006, the Company adopted SFAS123R usingthe modified prospective

transition method. Accordingly, the financial statements for periods prior to January 1, 2006 have not

been restated to reflect the adoption of SFAS 123R. Under the modified prospective transition