OfficeMax 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.71

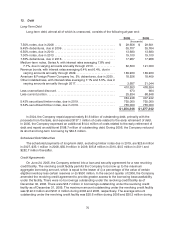

2005.Letters of credit, which may be issued under the revolver up to a maximum of $100 million,

reduce available borrowing capacity under the revolving credit facility. Letters of credit issued under

the revolver totaled $75.5million as of December 30, 2006. As of December 30, 2006, the maximum

aggregate amount available under therevolver was $500.0 million and $424.5 was available for

borrowing.

Borrowings under the revolver bear interest at rates based on either the prime rate or the London

Interbank Offered Rate (“LIBOR”). Margins are applied to the applicable borrowing rates and letter of

credit fees under the revolver depending on the level of average excess availability. For borrowings

outstanding under the revolver during 2006 and 2005, the weighted average interest rate was equal to

6.9% and 6.6%, respectively. Fees onletters of credit issued under the revolver were chargedat a

weighted average rate of 1.125%. The Company is also charged an unused line fee of 0.25% on the

amount by whichthe maximum available credit of $500 million exceeds the average daily outstanding

borrowings and letters of credit.

Borrowings under the revolver are secured by a lien on substantially all inventory and related

proceeds. The revolving loan and security agreement contains customary conditions to borrowing

including amonthly calculation of excess borrowing availability and reporting compliance. Covenants

in the revolver agreement restrict the amount of letters of creditthat may be issued, dividend

distributions and other uses of cash ifexcess availability isless than $75million. At December 30,

2006,the Company was incompliance with all covenants under the revolver agreement and excess

availability was in excess of $75 million. Therevolver expires on June 24, 2010.

Timber Notes

In October 2004, the Company sold its timberlands as part of the Sale and receivedcredit-

enhanced timber installmentnotes receivable in the amount of $1,635 million. In December 2004,the

Company completed a securitization transaction inwhich its interests in the timber installment notes

receivable and related guarantees were transferred to wholly-owned bankruptcy remote subsidiaries

that were designated to be qualifying special purposeentities (the “OMXQ’s”). The OMXQ’s pledged

the timber installment notes receivable and related guarantees and issued securitization notes in the

amount of$1,470 million. Recourse on the securitization notes is limited to the pledged timber

installment notes receivable. Thesecuritizationnotes are 15-year non-amortizing,and were issued in

two equal $735 million tranches paying interest of5.42% and 5.54%, respectively.

As a resultofthese transactions, OfficeMaxreceived $1,470 million in cash from the OMXQ’s,and

over 15 years will earn approximately $82.5 million per year ininterest incomeonthe timber

installment notes receivable and incur annual interest expense of approximately$80.5 million on the

securitization notes. Thepledged timber installment notes receivable andnonrecourse securitization

notes will mature in2020 and2019, respectively. Thesecuritization notes have an initial term that is

approximately three months shorter than the installmentnotes. The Company expects to refinance its

ownership of the installmentnotes in 2019 with ashort-term secured borrowing to bridge the period

from initial maturity of the securitization notes to the maturity of the installment notes.

The original entities issuing the credit enhanced timber installment notes are variable-interest

entities (the “VIE’s”) under FASB Interpretation 46R, “Consolidation of Variable Interest Entities”. The

OMXQ’s are considered to be theprimary beneficiary, and therefore, the VIE’s are required to be

consolidated with the OMXQ’s, which are also the issuers of the securitization notes. As a result, the

accounts of the OMXQ’s have been consolidated into those of their ultimate parent, OfficeMax. The

effect of the Company’s consolidation of the OMXQ’s is that the securitization transaction is treated as

a financing, andboth the timber notes receivable and the securitization notespayable are reflected in

the Consolidated Balance Sheets.