OfficeMax 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

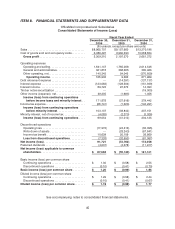

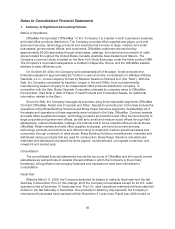

Notes to Consolidated Financial Statements

1. Summary of Significant Accounting Policies

Nature of Operations

OfficeMaxIncorporated (“OfficeMax” or the “Company”) is a leaderin both business-to-business

and retail office productsdistribution. The Company provides office supplies and paper, print and

document services, technology products and solutions and furniture to large,medium and small

businesses, governmental offices, and consumers.OfficeMax customers are serviced by

approximately 36,000 associates through direct sales, catalogs, the Internet and a network of retail

stores located throughout the United States, Canada, Australia, New Zealand and Mexico. The

Company’s common stock is tradedonthe New York Stock Exchange under the ticker symbol OMX.

The Company’s corporate headquarters is located inNaperville,Illinois, and the OfficeMax website

address is www.officemax.com.

On October 29, 2004, the Company sold substantially all of its paper, forest products and

timberland assets for approximately $3.7 billion in cash and other consideration to affiliates of Boise

Cascade, L.L.C., a new company formed by Madison Dearborn Partners LLC (the “Sale”). With the

Sale,the Company completed its transition, begun inthe mid-1990s, from a predominantly

manufacturing-based company to an independentoffice products distribution company. In

connectionwith the Sale, Boise Cascade Corporation changed its company name to OfficeMax

Incorporated. (See Note 2, Sale of Paper, Forest Products and Timberland Assets, for additional

information related to theSale.)

Since the Sale, the Company manages its business using three reportable segments: OfficeMax,

Contract; OfficeMax, Retail; and Corporate and Other. Resultsfor periods prior to the Sale include the

operations of the Boise Building Solutions andBoise Paper Solutions segments. Substantially all of

the assets and operations of these segmentswere included in the Sale. OfficeMax, Contract markets

and sells office supplies and paper, technology products and solutions and office furniture directly to

large corporate and government offices, as well as to small and medium-sized offices through field

salespeople, outbound telesales, catalogs, the Internet and in some markets office productsstores.

OfficeMax, Retail markets and sells office supplies and paper, print and document services,

technology products and solutions and office furniture to small and medium-sized businesses and

consumers througha network of retail stores. Boise Building Solutions manufactured, marketed and

distributed various productsthat are used for construction. Boise Paper Solutions manufactured,

marketed and distributed uncoated free sheet papers, containerboard, corrugated containers, and

newsprint and market pulp.

Consolidation

The consolidated financial statements include the accounts ofOfficeMax and all majority owned

subsidiaries as well as those of variable interest entities in which the Company is the primary

beneficiary. All significant intercompany balances and transactions have been eliminated in

consolidation.

Fiscal Year

Effective March 11,2005, the Company amended its bylaws to make itsfiscal year-end the last

Saturday in December. Prior to this change, all of the Company’s businesses except for its U.S. retail

operations had a December 31 fiscal year-end. The U.S. retailoperations maintained a fiscal year that

ended on the last Saturday in December.Due primarily to statutory requirements, the Company’s

international businesses have maintained their December 31 year-ends. Fiscal year 2006 ended on