OfficeMax 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

associates in the paper and forest products businesses, and transferred the associated assets and

obligations to the new plans. Effective October 29, 2004, under the terms of theAsset Purchase

Agreement with affiliates of Boise Cascade, L.L.C., we transferred sponsorship of the plans covering

active employees ofthe paper and forest products businesses to Boise Cascade, L.L.C.,and only

those terminated vested employees and retirees whose employment withus ended onorbefore

July 31, 2004, andsome active OfficeMax, Contract employees were covered under the plans

remaining with us. OfficeMax, Retail employees, among others,never participated in the pension

plans. The salaried pension plan was closed to new entrants on November 1, 2003, and on

December 31, 2003, the benefits of OfficeMax, Contract participants were frozen with one additional

year of service provided to active OfficeMax, Contract employees on January 1, 2004, at a reduced

1% crediting rate. As a result of the closure,freeze and spin-off, our annual pension expense and

contributions to theplans going forward will be less than the amounts included in prior periods.

We account for pension expense in accordance with SFAS No. 87, “Employer’s Accounting for

Pensions.”This statement requires us to calculate our pension expense and liabilities using actuarial

assumptions, including adiscount rate assumption and a long-term asset return assumption. We base

our discount rate assumption on the rates of returnon high-quality bonds currently available and

expected to be available during the period to maturity of the pension benefits.We base our long-term

asset return assumption on the average rateofearnings expected oninvested funds. We believe that

the accounting estimate related to pensions is a critical accounting estimatebecause it is highly

susceptible to change from period to period, based on the performance of plan assets, a ctuarial

valuations and changes in interest rates, and theeffect on ourfinancial position and results of

operations could be material.

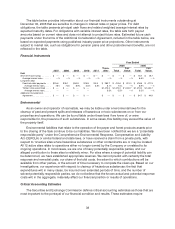

For 2007, our discount rate assumption used in the measurement of our net periodic benefit cost

was 5.8%, and our expected return onplan assets was 8.0%. Using these assumptions, our 2007

pension expense will be approximately $10.0 million. If we were to decrease our estimated discount

rate assumption used in the measurement of our net periodic benefit cost to 5.55% and our expected

return on plan assets to 7.75%, our 2007 pension expense would be approximately $14.6 million. Ifwe

were to increase our discount rate assumption used inthe measurement ofour net periodic benefit

cost to 6.05% and our expected return onplan assetsto 8.25%, our 2007 pension expense would be

approximately $5.4million.

The Company adopted SFAS No. 158, “Employer’s Accounting for Defined Pension and Other

Postretirement Plans—an amendment of FASB Statements No. 87, 88, 106 and 132(R),” effective

December 30, 2006. This statement requires the recognition of the funded status of a defined benefit

plan in the statement of financial position, and that changes in the funded status be recognized

through other comprehensive income (OCI), net of tax, inthe year in which the changes occur.

Actuarially-determined liabilities related topension and postretirement benefitsare alsorecorded

based on estimatesand assumptions. Key factors used in developing estimates of these liabilities

include assumptions related to discount rates, rates of return on investments, future compensation

costs, healthcare cost trends, benefit payment patterns and other factors. At December 30, 2006, the

fundedstatus of our defined benefit pension and other postretirement benefit plans was a liability of

$230.1 million. Changes in assumptions related to the measurement of funded status couldhave a

material impact on the amount reported.

Facility Closure Reserves

The Company conducts regular reviews of its real estate portfolio to identify underperforming

facilities, and closes those facilities that are no longer strategically or economically viable. Aliability for

the cost associated with such a closure is recorded at its fair value in the period in which it is incurred.

These costs are included in facility closure reserves in our Consolidated Balance Sheets and include

provisions forthe present valueoffuture lease obligations, less estimated sublease income. At