OfficeMax 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

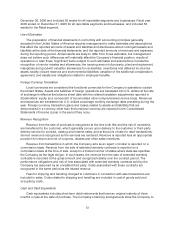

Merchandise Inventories

Inventories consist of office products merchandise and are stated at the lower of weighted

average cost or net realizable value. The Company estimates the realizable value of inventory using

assumptions about future demand, market conditions and product obsolescence. If the estimated

realizable value is less than cost, the inventory value is reduced to its estimated realizable value.

Throughout the year, the Company performs physical inventory counts at all locations.For

periods subsequent to each retail location’s last physical inventory count, an allowancefor estimated

shrinkageis provided based on historical shrinkresults and current business trends.

Property and Equipment

Property and equipment are recorded at cost. The Company calculates depreciation using the

straight-line method over the estimated useful lives ofthe assets or the terms of the related leases.

The estimated useful lives of depreciable assets are generally as follows: building and improvements,

5 to 40 years; furniture and equipment, 1.5 to 5years; and machinery, equipment anddelivery trucks,

5 to 10 years. Leasehold improvements are amortized over the lesser of the term of thelease,

including any option periods that management believesare probable of exercise, or the estimated

lives of the improvements, which generally range from 5 to 15 years. Depreciation on assetsusedin

the Company’s sold paper and forest products operations was determined using either the straight-

line method or a units-of-production method that approximated straight-line over three to five years.

Long-Lived Asset Impairment

In accordance with SFAS No. 144, “Accounting for theImpairment or Disposal of Long-Lived

Assets,” long-lived assets, such as property, plant, and equipment, capitalized software costs and

purchased intangibles subject to amortization, are reviewed for impairment whenever events or

changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

Recoverability of assets to be heldand used is measured by a comparisonof thecarryingamount of

an asset to theestimated undiscounted future cash flows expected to be generated by the asset. If the

carrying amount of an asset exceeds its estimated future cashflows, an impairmentcharge is

recognized equal to theamount by which the carrying amount of the asset exceeds the fair value of

the asset. Assets to be disposed of are separately presentedin the Consolidated Balance Sheets and

reported at the lower of the carrying amount or fair value less costs to sell, and are no longer

depreciated.

Goodwill and Intangible Assets

The Company accounts for goodwill and other indefinitelife intangibleassets in accordance with

SFAS No. 142, “Goodwill and Other Intangible Assets.” Goodwillrepresentsthe excess of purchase

price and related direct costs over the value assigned to the nettangible and identifiable intangible

assets of businesses acquired. Goodwill and intangible assets with indefinite lives are not amortized,

but are tested for impairment at least annually, or more frequently ifeventsand circumstances

indicatethat the asset mightbeimpaired, using a fair-value-based approach. An impairment loss is

recognized to the extentthat the carrying amount exceeds the asset’s fair value. This determination is

made at the reportingunit level and consists of two steps. First, the Company determines the fair

value of a reporting unit and compares it to its carrying amount. Second, if the carrying amount of a

reporting unit exceeds its fair value, an impairment loss is recognizedfor any excess of the carrying

amount ofthe reporting unit’s goodwill over theimplied fair value ofthat goodwill. Theimplied fair

value of goodwill is determined by allocating the fair valueofthe reporting unit in a manner similar to a

purchase price allocation in accordance with SFAS No. 141, “Business Combinations.” The residual

fair value after this allocation is theimplied fair valueof thereporting unit goodwill. The Company