OfficeMax 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54

completedits annual assessment in accordance with the provisions of SFAS No. 142 in the first

quarters of 2006 and 2005, and concluded there was no impairment. The Company completed an

additional assessment of the carrying valueofthe goodwill inthe OfficeMax, Retail segment in the

fourth quarter of 2005, in connection with the closure of 109 retail stores in2006, and concluded there

was no impairment.

Intangible assets represent the values assigned to trade names, customer lists andrelationships,

noncompete agreements and exclusive distribution rights of businesses acquired. Trade name assets

have an indefinite life and are not amortized.All other intangible assets are amortized on astraight-line

basis over their expected useful lives, which range from three to 20 years.(See Note 11, Goodwill and

Intangible Assets, for additional information related to goodwill and intangible assets.)

Investments in Affiliates

Investments in affiliated companies that represent less than 20%voting interest are accounted for

under the cost method if theCompany doesnot exercise significant influence over theaffiliated

company. At December 30, 2006 and December 31,2005,the Company held an investment inBoise

Cascade, L.L.C.,which is accounted forunder the cost method. Investments that enable the

Company to exercise significant influence over an affiliated company, but donot represent a

controlling interest, are accounted for under the equity method; such investments are carried at cost

and are adjusted to reflect the Company’s proportionate share of income or loss, less dividends

received. The Company periodically reviewsthe recoverability of investmentsin affiliates.The

Companywould recognize aloss on these inves tmentsif there is a loss invalue of an investment

which is other than a temporary decline. (See Note 10,InvestmentsinAffiliates, for additional

information related to the Company’s investments inaffiliates.)

Capitalized Software Costs

The Company capitalizescertain costsrelated to the acquisition anddevelopment of internal use

software that is expected to benefit future periods in accordance with American Institute of Certified

Public Accountants’ Statement ofPosition (SOP) 98-1, “Accounting for the Costs of Computer

Software Developed or Obtained for Internal Use.” These costs are amortized using the straight-line

method over the expectedlifeof the software, which is typically three tofive years.Deferred charges

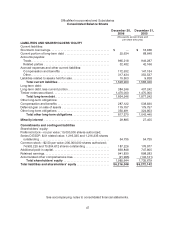

in the ConsolidatedBalance Sheets include unamortized capitalized software costsof $25.7 million

and $36.7 million at December 30, 2006 and December 31, 2005, respectively. Amortization of

capitalized software costs totaled $17.7 million, $25.6 million and $25.2 million in 2006, 2005 and

2004, respectively.

Software development costs that do not meet the criteria for capitalization are expensedas

incurred.

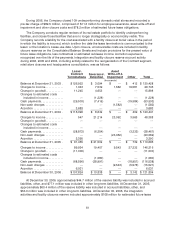

Facility Closure Reserves

The Company conducts regular reviews of its real estate portfolio to identify underperforming

facilities,and closes those facilities that are no longer strategically or economically viable. The

Company accounts for facility closure costs that are not relatedto a purchasebusiness combination

in accordance with SFAS No. 146, “Accounting for Costs Associated withExit or Disposal Activities.”

In accordance with SFASNo. 146, the Company records a liability for the cost associated with a

facility closureat its fair value in the period in which the liability is incurred, which is either the date the

lease termination is communicated to the lessor or the location’s cease-use date. Upon closure,

unrecoverable costsare includedinfacility closure reserves on theConsolidated Balance Sheets and

include provisions for the present value offuture lease obligations,less contractual or estimated

sublease income. Accretion expense is recognized over the life of the payments.