OfficeMax 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

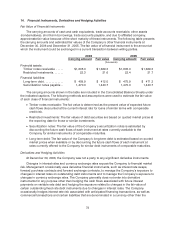

14. Financial Instruments, Derivatives and Hedging Activities

Fair Value of Financial Instruments

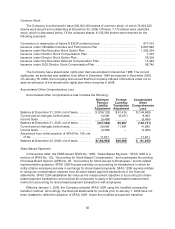

The carrying amounts of cashand cash equivalents,trade accounts receivable, other assets

(nonderivatives), short-term borrowings, trade accounts payable, and due to affiliated company,

approximate fair value because of the short maturity of these instruments.The following table presents

the carrying amounts and estimated fair values of theCompany’s other financial instruments at

December 30, 2006 and December 31,2005.The fair value of a financial instrumentis the amount at

which the instrument could be exchanged inacurrent transaction betweenwilling parties.

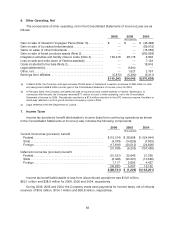

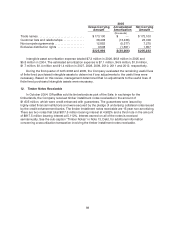

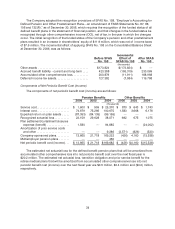

20062005

Carrying amount Fairvalue Carrying amount Fairvalue

(thousands)

Financial assets:

Timber notesreceivable ..... $1,635.0 $ 1,669.3$ 1 ,635.0 $ 1,669.3

Restricted investments. ...... 22.3 21.6 22.4 21.7

Financial liabilities:

Long-termdebt............. $409.9 $ 412.0$ 475.9$ 471.3

Securitization notes payable.. 1,470.0 1,440.7 1,470.0 1,440.7

The carrying amounts shown in the table are includedin the Consolidated Balance Sheets under

the indicated captions. The following methods and assumptions were used to estimate the fair value

of each class of financial instruments:

•Timber notes receivable: The fair value isdetermined as the present value of expected future

cash flows discounted at the current interest rate for loans of similar terms with comparable

credit risk.

•Restricted investments: The fair values of debt securities are based onquoted market prices at

the reporting date for those or similar investments.

•Securitization notes: The fair value of the Company’s securitization notes is estimated by

discounting the future cash flows of each instrument at rates currently available to the

Company for similar instruments of comparable maturities.

•Long-term debt: The fair value of theCompany’s long-term debt is estimated based onquoted

market prices when available or by discounting the future cash flows of each instrument at

rates currently offered to the Company for similar debt instruments of comparable maturities.

Derivatives and Hedging Activities

At December 30, 2006, the Company was not a party to any significant derivative instruments.

Changes in interest rates and currency exchange rates expose the Company to financial market

risk. Management occasionally uses derivative financial instruments, such as interest rate swaps,

forward purchase contracts andforward exchange contracts, to manage the Company’s exposureto

changes ininterest rates on outstanding debt instruments and to manage theCompany’s exposure to

changes in currency exchange rates.The Company generally does not enter into derivative

instruments for any purpose other thanhedging the cash flows associated with future interest

payments on variable ratedebt and hedging the exposure related to changes inthe fair value of

certain outstanding fixed rate debt instruments due to changes ininterest rates. The Company

occasionally hedges interest rate risk associated with anticipated financing transactions, as well as

commercial transactions and certain liabilities that are denominated in a currency other thanthe