MoneyGram 2005 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

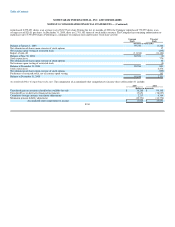

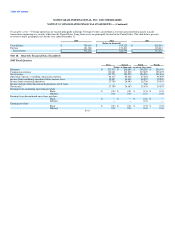

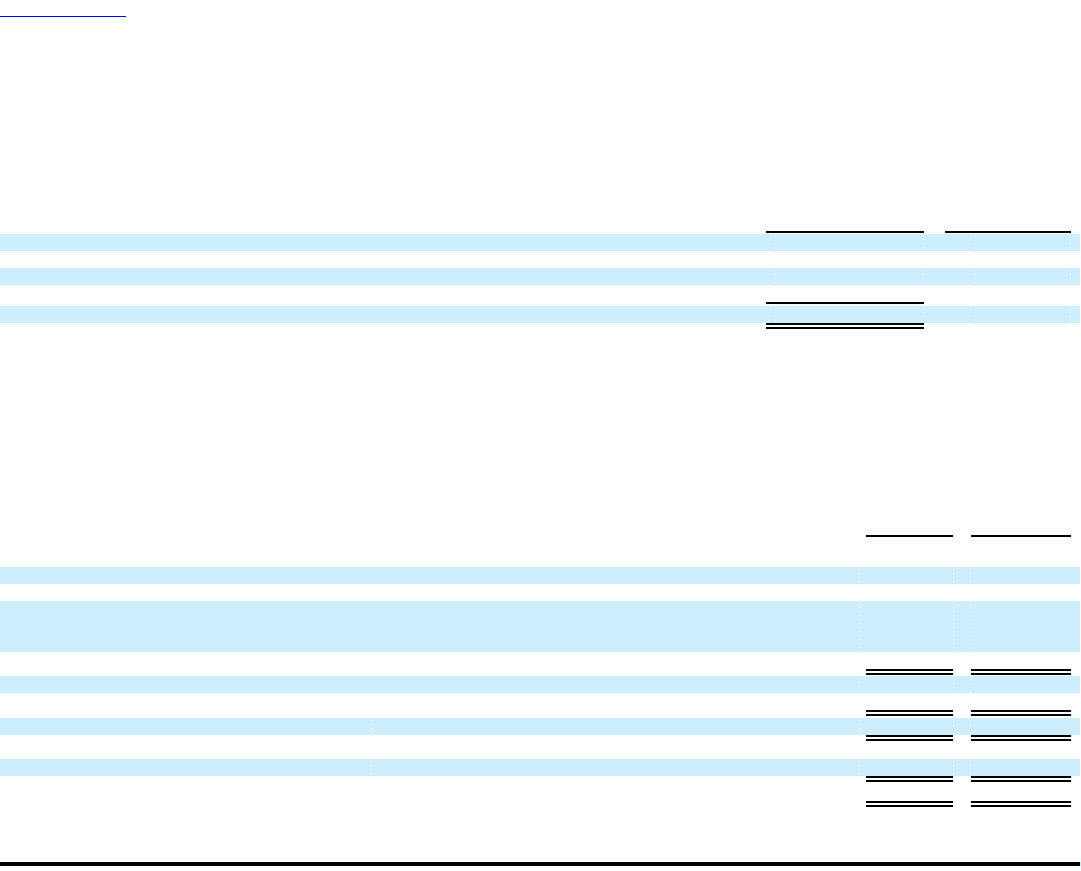

Restricted stock awards were valued at the quoted market price of the Company's common stock on the date of grant and expensed using the straight-line

method over the vesting or service period of the award. Following is a summary of restricted stock activity:

Weighted

Total Average

Shares Price

Restricted stock outstanding at December 31, 2004 1,097,145 $ 19.06

Granted 118,400 $ 19.79

Vested and issued (499,436) $ 20.33

Forfeited (23,170) $ 18.19

Restricted stock outstanding at December 31, 2005 692,939 $ 18.28

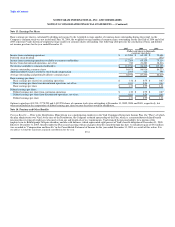

During 2005, the Company recognized expense totaling $1.5 million related to its options; no expense was recognized in 2004 or 2003. The Company

recognized expense totaling $2.3 million, $1.9 million and $1.4 million related to its restricted stock in 2005, 2004 and 2003, respectively. As of

December 31, 2005, there was $3.2 million and $1.5 million of total unrecognized compensation expense related to nonvested options and restricted stock,

respectively. That expense is expected to be recognized over a weighted average period of 2.13 years for options and 0.62 years for restricted stock. The total

fair value of options that vested during 2005, 2004 and 2003 was $9.3 million, $20.2 million and $31.5 million, respectively, on the vesting date. (The fair

value of options that vested during 2004 and 2003 are based on the historical Viad stock price.) The total fair value of restricted stock that vested during 2005

and 2004 was $9.9 million and $5.8 million. No restricted stock vested in 2003.

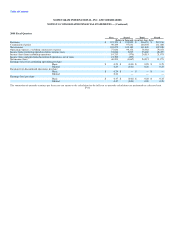

Assuming that the Company had recognized compensation cost for stock option grants in accordance with the fair value method of accounting prior to

January 1, 2005, net income and diluted and basic income per share would be as follows:

2004 2003

(Dollars in thousands,

except per share data)

Net income, as reported $ 86,412 $ 113,902

Plus: stock-based compensation expense recorded under APB 25, net of tax 1,483 1,406

Less: stock-based compensation expense determined under the fair value method,

net of tax (3,869) (6,058)

Pro forma net income $ 84,026 $ 109,250

Basic earnings per share:

As reported $ 0.99 $ 1.31

Pro forma $ 0.97 $ 1.27

Diluted earnings per share:

As reported $ 0.99 $ 1.31

Pro forma $ 0.96 $ 1.26

F-39