MoneyGram 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

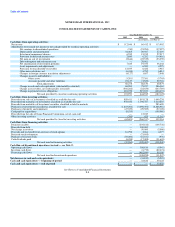

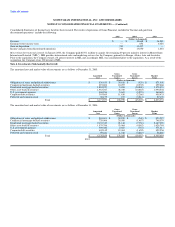

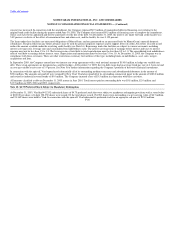

$14.6 million relating primarily to legal and consulting costs. The results of operations of Viad included in "Income and gain from discontinued operations" in

the Consolidated Statement of Income include the following:

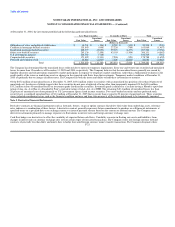

2005 2004 2003

(Dollars in thousands)

Revenue $ — $ 414,933 $ 770,468

Earnings before income taxes — 13,495 60,142

Income from discontinued operations — 8,233 36,386

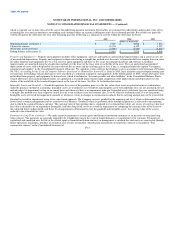

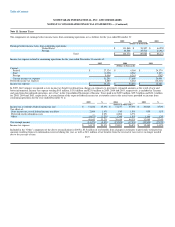

As part of the transaction, the Company entered into several agreements with Viad for the purpose of governing the relationship. A Separation and

Distribution Agreement provides for the principal corporate transactions required to effect the separation of MoneyGram from Viad and the spin-off and other

matters governing the relationship between New Viad and MoneyGram following the spin-off. The Employee Benefits Agreement provides for the allocation

of employees, employee benefit plans and associated liabilities and related assets between Viad and MoneyGram. The Interim Services Agreement provides

for services to be provided by Viad for MoneyGram on an interim basis. The Tax Sharing Agreement provides for the allocation of federal, state, and foreign

tax liabilities for all periods through the Distribution Date.

The services to be provided under the Interim Services Agreement will generally be provided by New Viad for a term of two years beginning on the

Distribution Date. The Company may, at any time after the first year anniversary of the Distribution, request termination of the service upon 90 days advance

notice to Viad. However, certain services may not be terminated prior to the second anniversary of the Distribution Date without Viad's consent. Under the

Interim Services Agreement, the Company was obligated to pay approximately $1.6 million annually. On July 1, 2005, the Company notified Viad of our

termination of certain services under the Interim Services Agreement effective on September 28, 2005. As a result of this termination, payments to Viad are

less than $0.1 million in the fourth quarter of 2005 and first quarter of 2006. On December 22, 2005, we notified Viad of our termination of substantially all of

the remaining services under the Interim Services Agreement effective in the second quarter of 2006. Any remaining services provided by Viad will terminate

on June 30, 2006. During 2005 and 2004, expenses totaling $1.4 million and $0.8 million, respectively, were recognized in connection with this agreement.

In January 2005, the Company acquired a 50% interest in a corporate aircraft owned by Viad at a cost of $8.6 million. The Company paid 50% of all fixed

costs associated with this asset and was responsible for the variable costs associated with its direct usage of the asset. In January 2006, the Company acquired

the remaining 50% interest in the corporate aircraft at a cost of $10.0 million.

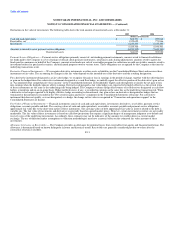

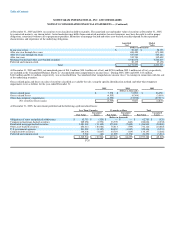

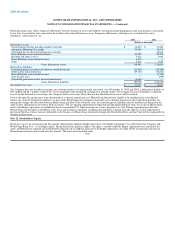

Game Financial Corporation: During the first quarter of 2004, the Company completed the sale of a subsidiary, Game Financial Corporation ("Game

Financial"), for approximately $43.0 million in cash, resulting in net cash received of $15.2 million. Game Financial provides cash access services to casinos

and gaming establishments throughout the United States and was part of our Payment Systems segment. As a result of the sale, the Company recorded a gain

of approximately $18.9 million ($11.4 million after-tax) in 2004. In addition, the Company recorded a gain of $1.1 million (net of taxes) in 2004 as a result of

the settlement of a lawsuit brought by Game Financial. In 2005, the Company recorded a gain of $0.7 million (net of taxes) due to the partial resolution of

contingencies relating to the sale of Game Financial. The Company has a $4.8 million liability recorded in "Accounts payable and other liabilities" in the

Consolidated Balance Sheets in connection with a contingency in the Sales and Purchase Agreement related to the continued operations of Game Financial

with one casino. This contingency is expected to be resolved in 2006.

In accordance with SFAS No. 144, the results of operations of Game Financial and the gain on the disposal of Game Financial have been reflected as

components of discontinued operations. All prior periods in the historical F-18