MoneyGram 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Viad stockholders in a tax-free distribution. Stockholders of Viad received one share of MoneyGram common stock for every one share of Viad common

stock owned.

The continuing business of Viad consists of the businesses of the convention show services, exhibit design and construction, and travel and recreation services

operations, including Viad's centralized corporate functions located in Phoenix, Arizona ("New Viad"). Notwithstanding the legal form of the spin-off, due to

the relative significance of MoneyGram to Viad, MoneyGram is considered the divesting entity and treated as the accounting successor to Viad for financial

reporting purposes in accordance with the Emerging Issues Task Force ("EITF") Issue No. 02-11 Accounting for Reverse Spin-offs. The spin-off of New Viad

has been accounted for pursuant to Accounting Principles Board ("APB") Opinion No. 29, Accounting for Non-Monetary Transactions. MoneyGram charged

$426.6 million directly to equity as a dividend, which is the historical cost carrying amount of the net assets of New Viad.

As part of the separation from Viad, we entered into a variety of agreements with Viad to govern each of our responsibilities related to the distribution. These

agreements include a Separation and Distribution Agreement, a Tax Sharing Agreement, an Employee Benefits Agreement and an Interim Services

Agreement. See Note 3 to the Consolidated Financial Statements.

In connection with the spin-off, we entered into a bank credit agreement providing availability of up to $350.0 million in the form of a $250.0 million

revolving credit facility and a $100.0 million term loan. On June 30, 2004, we borrowed $150.0 million under this facility, which was paid to and used by

Viad to repay $188.0 million of its commercial paper. Viad also retired a substantial majority of its outstanding subordinated debentures and medium term

notes for an aggregate amount of $52.6 million (including a tender premium), retired industrial revenue bonds of $9.0 million and redeemed outstanding

preferred stock at an aggregate call price of $23.9 million.

Basis of Presentation

Our consolidated financial statements are prepared in conformity with accounting principles generally accepted in the United States of America ("GAAP").

The consolidated financial statements include the historical results of operations of Viad in discontinued operations in accordance with the provisions of

Statement of Financial Accounting Standards ("SFAS") No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets. There are certain amounts

related to other investment income, debt and costs associated with Viad's centralized corporate functions that are related to Viad, but in accordance with

GAAP are not allowed to be reflected in discontinued operations as these costs were not specifically allocated to Viad subsidiaries. The consolidated financial

statements may not necessarily be indicative of our results of operations, financial position and cash flows in the future or what our results of operations,

financial position and cash flows would have been had we operated as a stand-alone company during the periods presented.

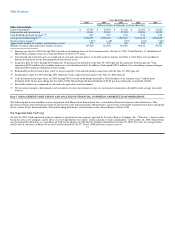

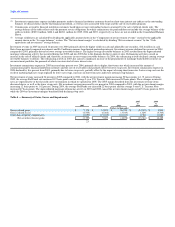

In March 2004, we completed the sale of Game Financial Corporation for approximately $43.0 million in cash. Game Financial Corporation provides cash

access services to casinos and gaming establishments throughout the United States. As a result of the sale, we recorded an after-tax gain of $11.4 million in

the first quarter of 2004. In addition, in June 2004, we recorded an after-tax gain of $1.1 million from the settlement of a lawsuit brought by Game Financial

Corporation. During 2005, we recorded a $0.7 million gain in connection with the partial resolution of contingencies relating to the sale of Game Financial

Corporation. These amounts are reflected in the Consolidated Statements of Income in "Income and gain from discontinued operations, net of tax," along with

the operating results of Viad, including spin related costs of $14.6 million. The following discussion of our results of operations is focused on our continuing

businesses. 18