MoneyGram 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

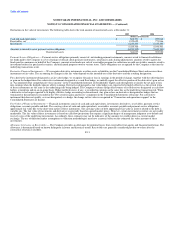

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

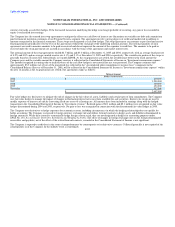

accounting principle if it is required by a newly issued accounting pronouncement or the entity can justify the use of an allowable alternative accounting

principle on the basis that it is preferable. This statement also requires that corrections for errors discovered in prior period financial statements be reported as

a prior period adjustment by restating the prior period financial statements. Additional disclosures are required when a change in accounting principle or

reporting entity occurs, as well as when a correction for an error is reported. The statement is effective for the Company for fiscal 2006. No material impact is

anticipated as a result of the adoption of this statement.

In November 2005, the FASB issued FASB Staff Position ("FSP") Nos. 115-1 and 124-1, The Meaning of Other-Than-Temporary Impairment and Its

Application to Certain Investments. The FSPs address the determination as to when an investment is considered impaired, whether that impairment is other-

than-temporary and the measurement of an impairment loss, as well as sets forth disclosure requirements for investments in an unrealized loss position. The

Company has adopted the FSPs effective December 31, 2005 and included all required disclosures in Note 4. There was no material impact as a result of the

adoption of these FSPs.

In January 2006, the FASB issued FSP No. 45-3, Application of FASB Interpretation No. 45 ("FIN 45") to Minimum Revenue Guarantees Granted to a

Business or Its Owners. This FSP amends FIN 45 to include guarantees granted to a business that its revenue for a specified period of time will be at least a

specified amount. FIN 45 requires that a company record an obligation at the inception of a guarantee equal to the fair value of the guarantee, as well as

disclose certain information relating to the guarantee. The FSP is applicable for minimum revenue guarantees issued or modified by the Company on or after

January 1, 2006, with no revision or restatement to the accounting treatment of such guarantees issued prior to the adoption date allowed. The disclosure

requirements of FIN 45 will be applicable to all outstanding minimum revenue guarantees. The Company has not completed its assessment of the impact of

this FSP, but does not expect it to be material to its consolidated financial statements.

In February 2006, the FASB issued FSP No. 123R-4, Classification of Options and Similar Instruments Issued as Employee Compensation That Allow for

Cash Settlement upon the Occurrence of a Contingent Event. This FSP amends SFAS No. 123R to require that stock options issued to employees as

compensation be accounted for as equity instruments until a contingent event allowing for cash settlement is probable of occurring. The Company has adopted

FSP No. 123R-4 effective January 1, 2006 with no impact to the Company's consolidated financial statements.

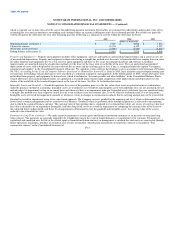

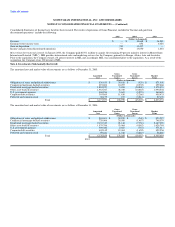

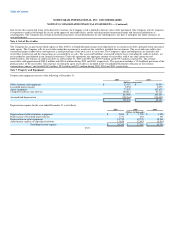

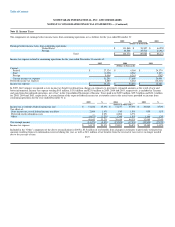

Note 3. Acquisitions and Discontinued Operations

ACH Commerce: On April 29, 2005, the Company acquired substantially all of the assets of ACH Commerce L.L.C., an automated clearing house payment

processor, for a purchase price of $8.5 million. The acquisition provides the Company with the technology and systems platform to expand its line of payment

services. The financial impact of the acquisition is not material to the Consolidated Balance Sheets or the Consolidated Statements of Income.

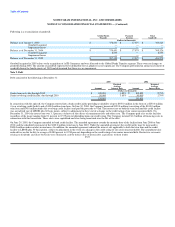

Viad Corp: MoneyGram is considered the divesting entity and treated as the "accounting successor" to Viad for financial reporting purposes. The continuing

business of Viad is referred to as "New Viad." The spin off of New Viad was accounted for pursuant to APB Opinion No. 29, Accounting for Nonmonetary

Transactions, and was based upon the recorded amounts of the net assets divested. On June 30, 2004, the Company charged the historical cost carrying

amount of the net assets of New Viad of $426.6 million directly to equity as a dividend. As a result, New Viad's results of operations (with certain

adjustments) are included in the Consolidated Statement of Income in "Income and gain from discontinued operations" in accordance with the provisions of

SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets. Also included in "Income and gain from discontinued operations" in the

Consolidated Statement of Income for 2004 is a charge for spin-off related costs of

F-17