MoneyGram 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

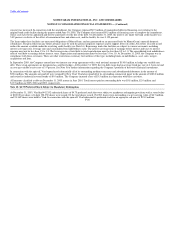

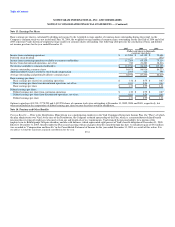

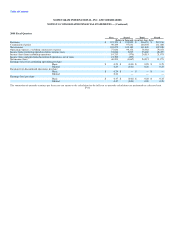

The health care cost trend rate assumption has a significant effect on the amounts reported. For measurement purposes, a 10.00 percent annual rate of increase

in the per capita cost of covered health care benefits was assumed for both 2005 and 2004, respectively. For 2005, the rate was assumed to decrease gradually

to 5.00 percent by the year 2013 and remain at that level thereafter. For 2004, the rate was assumed to decrease gradually to 5.00 percent by the year 2010 and

remain at that level thereafter. A one-percentage point change in assumed health care trends would have the following effects:

One One

Percentage Percentage

Point Point

Increase Decrease

(Dollars in thousands)

Effect on total of service and interest cost components $ 306 $ (237)

Effect on postretirement benefit obligation 2,755 (2,123)

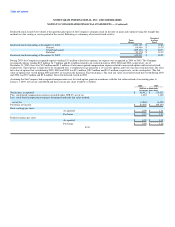

Employee Savings Plan — The Company has an employee savings plan that qualifies under Section 401(k) of the Internal Revenue Code. Contributions to,

and costs of, the 401(k) defined contribution plan totaled $2.2 million, $1.9 million and $1.2 million in 2005, 2004 and 2003, respectively. At the time of the

Distribution, MoneyGram's new savings plan assumed all liabilities under the Viad Employees Stock Ownership Plan (the "Viad ESOP") for benefits of the

current and former employees assigned to MoneyGram, and the related trust received a transfer of the corresponding account balances. MoneyGram does not

have an employee stock ownership plan.

Employee Equity Trust — Viad sold treasury stock in 1992 to its employee equity trust to fund certain existing employee compensation and benefit plans. In

connection with the spin-off, Viad transferred 1,632,964 shares of MoneyGram common stock to a MoneyGram International, Inc. employee equity trust (the

"Trust") to be used by MoneyGram to fund employee compensation and benefit plans. The fair market value of the shares held by this Trust, representing

unearned employee benefits is recorded as a deduction from common stock and other equity and is reduced as employee benefits are funded. For financial

reporting purposes, the Trust is consolidated. As of December 31, 2005, 918,032 shares of MoneyGram common stock remained in the trust.

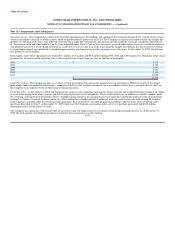

Deferred Compensation Plans — Viad had a deferred compensation plan for its non-employee directors and a deferred compensation plan for certain

members of management which allowed for the deferral of compensation in the form of stock units or cash. In connection with the deferred compensation

plans, Viad funded certain amounts through a rabbi trust. In connection with the spin-off, the Company paid a dividend of $7.3 million to Viad, which was

used to pay certain liabilities under the deferred compensation plans. The Company assumed liabilities totaling $6.6 million related to the plans and retained

rabbi trust assets totaling $5.5 million. Subsequent to the spin-off, the Company adopted a deferred compensation plan for its non-employee directors. Under

the director deferred compensation plan, non-employee directors may defer all or part of their retainers, fees and stock awards in the form of stock units or

cash. Director deferred accounts are payable upon resignation from the Board. In 2005, the Board of Directors approved a deferred compensation plan for

certain employees which allows for the deferral of base compensation in the form of cash. In addition, the Company makes contributions to the participants'

accounts for profit sharing contributions beyond the IRS 401(k) limits. Management deferred accounts are generally payable under the timing and method

elected by the participant on the deferral date. Deferred stock unit accounts are credited quarterly with dividend equivalents and will be adjusted in the event

of a change in our capital structure from a stock split, stock dividend or other change. Deferred cash accounts are credited quarterly with interest at a long-

term, medium-quality bond rate. Both deferred compensation plans are unfunded and unsecured and the Company is not required to physically segregate any

assets in connection with the deferred accounts. At December 31, 2005 and 2004, the Company had a liability related to the deferred compensation plans of

$7.0 million and $5.9 million, respectively, recorded in the "Other liabilities" component in the Consolidated Balance Sheets. The rabbi trust had a market

value of $6.6 million and $6.0 million at December 31, 2005 and 2004, respectively, recorded in "Other assets" in the Consolidated Balance Sheets.

F-36