MoneyGram 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Income. We review the carrying values of these incentive payments whenever events or changes in circumstances indicate that the carrying amounts may not

be recoverable in accordance with the provisions of SFAS No. 144, Accounting for the Impairment and Disposal of Long-Lived Assets.

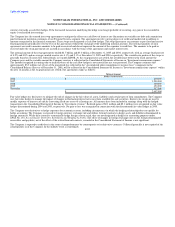

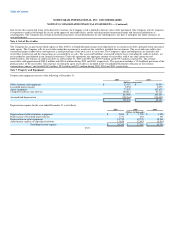

Income Taxes — Prior to the Distribution, income taxes were determined on a separate return basis as if MoneyGram had not been eligible to be included in

the consolidated income tax return of Viad and its affiliates. The provision for income taxes is computed based on the pretax income included in the

Consolidated Statement of Income. Deferred income taxes result from temporary differences between the financial reporting basis of assets and liabilities and

their respective tax-reporting basis. Deferred tax assets and liabilities are measured using the enacted tax rates expected to apply to taxable income in the years

in which those temporary differences are expected to reverse. Valuation allowances are recorded to reduce deferred tax assets when it is more likely than not

that a tax benefit will not be realized.

Treasury Stock — Repurchased common stock is stated at cost and is presented as a separate reduction of stockholders' equity.

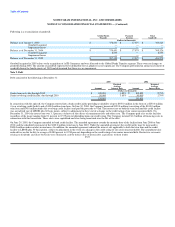

Foreign Currency Translation — The Euro is the functional currency of MoneyGram International Limited ("MIL"), a wholly owned subsidiary of

MoneyGram. Assets and liabilities for MIL are translated into U.S. dollars based on the exchange rate in effect at the balance sheet date. Income statement

accounts are translated at the average exchange rate during the period covered. Translation adjustments arising from the use of differing exchange rates from

period to period are included in "Accumulated other comprehensive income (loss)" in the Consolidated Balance Sheet.

Revenue Recognition — We derive revenue primarily through service fees charged to consumers and our investing activity. A description of these revenues

and recognition policies are as follows:

• Fee revenues primarily consist of transaction fees, foreign exchange revenue and other revenue.

– Transaction fees consist primarily of fees earned on the sale of money transfers, retail money orders and bill payment services. The money transfer

transaction fees are fixed fees per transaction that may vary based upon the face value of the amount of the transaction and the locations in which

these money transfers originate and to which they are sent. The money order and bill payment transaction fees are fixed fees charged on a per item

basis. Transaction fees are recognized at the time of the transaction or sale of the product.

– Foreign exchange revenue is derived from the management of currency exchange spreads (as a percentage of face value of the transaction) on

international money transfer transactions. Foreign exchange revenue is recognized at the time the exchange in funds occurs.

– Other revenue consists of processing fees on rebate checks and controlled disbursements, service charges on aged outstanding money orders, money

order dispenser fees and other miscellaneous charges. These fees are recognized in earnings in the period the item is processed or billed.

• Investment revenue is derived from the investment of funds generated from the sale of official checks, money orders and other payment instruments and

consists of interest income, dividend income and amortization of premiums and discounts. These funds are available for investment until the items are

presented for payment. Interest and dividends are recognized as earned. Premiums and discounts on investments are amortized using a straight-line method

over the life of the investment.

• Securities gains and losses are recognized upon the sale of securities using the specific identification method to determine the cost basis of securities sold.

Impairments are recognized in the period the security is deemed to be other-than-temporarily impaired.

Fee Commissions Expense — We pay fee commissions to third-party agents for money transfer services. In a money transfer transaction, both the agent

initiating the transaction and the agent disbursing the funds receive a F-15