MoneyGram 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

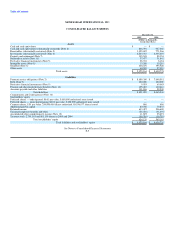

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

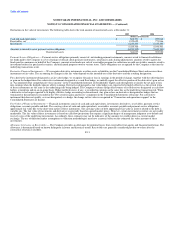

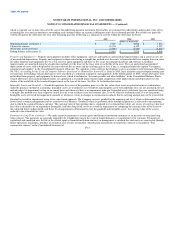

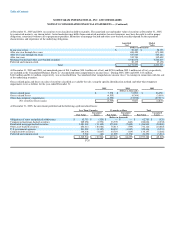

any securities as held-to-maturity until March 31, 2005. At December 31, 2005 and 2004, there are no securities classified as held-to-maturity.

Securities held for indefinite periods of time, including those securities that may be sold to assist in the clearing of payment service obligations or in the

management of securities, are classified as securities available-for-sale. These securities are reported at fair value, with the net after-tax unrealized gain or

loss reported as a separate component of stockholders' equity. There are no securities classified as trading securities.

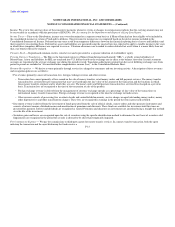

Other asset-backed securities are collateralized by various types of loans and leases, including home equity, corporate, manufactured housing, credit card

and airline. Interest income on mortgage-backed and other asset-backed securities for which risk of credit loss is deemed remote is recorded utilizing the

level yield method. Changes in estimated cash flows, both positive and negative, are accounted for with retrospective changes to the carrying value of

investments in order to maintain a level yield over the life of the investment in accordance with SFAS No. 91, Accounting for Nonrefundable Fees and Costs

Associated with Originating or Acquiring Loans and Initial Direct Costs of Leases. Interest income on mortgage-backed and other asset-backed investments

for which risk of credit loss is not deemed remote is recorded under the prospective method as adjustments of yield in accordance with EITF Issue

No. 99-20, Recognition of Interest Income and Impairment on Purchased and Retained Beneficial Interests in Securitized Financial Assets.

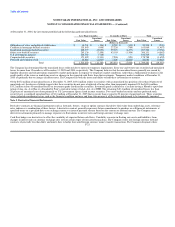

Securities with gross unrealized losses at the Consolidated Balance Sheet date are subject to our process for identifying other-than-temporary impairments in

accordance with SFAS No. 115, EITF Issue No. 99-20 and SEC Staff Accounting Bulletin No. 59, Views on Accounting for Noncurrent Marketable Equity

Securities. Securities that we deem to be other-than-temporarily impaired are written down to fair value in the period the impairment occurs. Under

SFAS No. 115, the assessment of whether such impairment has occurred is based on management's evaluation of the underlying reasons for the decline in

fair value on a security by security basis. We consider a wide range of factors about the security and use our best judgment in evaluating the cause of the

decline in the estimated fair value of the security and in assessing the prospects for recovery. We evaluate mortgage-backed and other asset-backed

investments rated A and below for which risk of credit loss is deemed more than remote for impairment under EITF Issue No. 99-20. When an adverse

change in expected cash flows occurs, and if the fair value of a security is less than its carrying value, the investment is written down to fair value. Any

impairment charges are included in the Consolidated Statement of Income under "Net securities gains and losses." If a security is deemed to not be impaired

under EITF 99-20, it is further analyzed under SFAS 115.

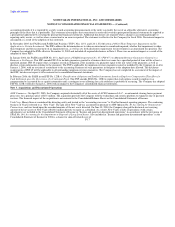

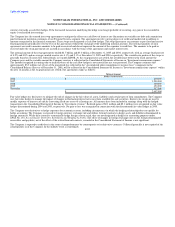

Substantially Restricted — We are regulated by various state agencies which generally require us to maintain liquid assets and investments with an investment

rating of A or higher in an amount generally equal to the payment service obligation for those regulated payment instruments, namely teller checks, agent

checks, money orders, and money transfers. Consequently, a significant amount of cash and cash equivalents, receivables and investments are restricted to

satisfy the liability to pay the face amount of regulated payment service obligations upon presentment. We are not regulated by state agencies for payment

service obligations resulting from outstanding cashier's checks; however, we restrict a portion of the funds related to these payment instruments due to

contractual arrangements and/or Company policy. Assets restricted for regulatory or contractual reasons are not available to satisfy working capital or other

financing requirements.

We have unrestricted cash and cash equivalents, receivables and investments to the extent those assets exceed all payment service obligations. These amounts

are generally available; however, management considers a portion of these amounts as providing additional assurance that regulatory requirements are

maintained during the normal F-12