MoneyGram 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

be required, any of these actions by a client could nonetheless diminish the value of the total investment portfolio, decrease earnings, and result in loss of the

client or other customers or prospects. We offer the special purpose entity to certain financial institution clients as a benefit unique in the payment services

industry.

The Company has investment grade ratings of BBB/ Baa2 and a stable outlook from the three major credit rating agencies. Our ability to maintain an

investment grade rating is important because it affects the cost of borrowing and certain financial institution customers require that we maintain an investment

grade rating. Any ratings downgrade could increase our cost of borrowing or require certain actions to be performed to rectify such a situation. A downgrade

could also have an effect on our ability to attract new customers and retain existing customers.

Although no assurance can be given, we expect operating cash flows and short-term borrowings to be sufficient to finance our ongoing business, maintain

adequate capital levels, and meet debt and clearing agreement covenants and investment grade rating requirements. Should financing requirements exceed

such sources of funds, we believe we have adequate external financing sources available to cover any shortfall, including unused commitments under our

credit facilities.

The Company has an effective universal shelf registration on file with the Securities and Exchange Commission. The universal shelf registration provides for

the issuance of up to $500.0 million of our securities, including common stock, preferred stock and debt securities. The securities may be sold from time to

time in one or more series. The terms of the securities and any offering of the securities will be determined at the time of the sale. The shelf registration is

intended to provide the Company with additional funding sources for general corporate purposes, including working capital, capital expenditures, debt

payment and the financing of possible acquisitions or stock repurchases.

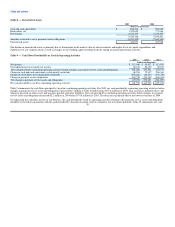

Stockholders' Equity

On June 30, 2004, MoneyGram charged the historical cost carrying amount of the net assets of Viad in the amount of $426.6 million directly to equity as a

dividend.

On November 18, 2004, the Board authorized a plan to repurchase, at the Company's discretion, up to 2,000,000 shares of MoneyGram common stock. On

August 19, 2005, the Company's Board of Directors increased its share buyback authorization by 5,000,000 shares to a total of 7,000,000 shares. In 2005, we

repurchased 2,275,651 shares of our common stock under this authorization at an average cost of $21.97 per share. As of December 31, 2005, we have

repurchased a total of 3,045,950 shares of our common stock under this authorization and have remaining authorization to purchase up to 3,954,050 shares.

During 2005, we paid $6.1 million in dividends on our common stock. In addition, the Board of Directors declared a dividend of $0.04 per share of common

stock on February 16, 2006 to be paid on April 3, 2006 to stockholders of record on March 17, 2006. Any future determination to pay dividends on

MoneyGram common stock will be at the discretion of our Board of Directors and will depend on our financial condition, results of operations, cash

requirements, prospects and such other factors as our Board of Directors may deem relevant. During 2005, we increased the quarterly dividend from $0.01 to

$0.04 per share. We intend to continue paying a quarterly dividend of $0.04 per share in 2006, subject to Board approval, which will be funded through cash

generated from operating activities.

Viad sold treasury stock in 1992 to its employee equity trust to fund certain existing employee compensation and benefit plans. In connection with the spin-

off, Viad transferred 1,632,964 shares of MoneyGram common stock to the MoneyGram International, Inc. employee equity trust (the "Trust") to be used by

MoneyGram to fund employee compensation and benefit plans. At December 31, 2005, the Trust held 918,032 shares of MoneyGram common stock. The

market value of the shares held by this Trust of $23.9 million at December 31, 2005 represents unearned employee benefits that are recorded as a deduction

from common stock and other equity and is reduced as employee benefits are funded. For financial reporting purposes, the Trust is consolidated.

34