MoneyGram 2005 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

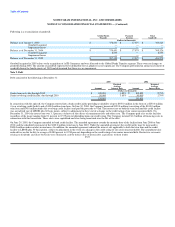

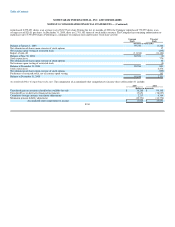

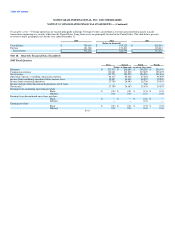

The Company's funding policy is to make contributions to the plan as benefits are required to be paid. Net periodic postretirement benefit cost includes the

following components for the year ended December 31:

2005 2004 2003

(Dollars in thousands)

Service cost $ 619 $ 515 $ 490

Interest cost 644 593 578

Amortization of prior service cost (294) (294) (288)

Recognized net actuarial loss 16 14 18

Net periodic benefit cost $ 985 $ 828 $ 798

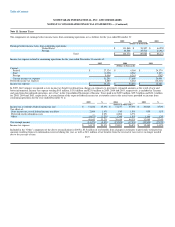

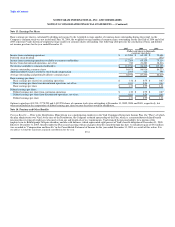

The benefit obligation and plan assets, changes to the benefit obligation and plan assets and a reconciliation of the funded status of the defined benefit

postretirement plan as of and for the year ended December 31 are as follows:

2005 2004

(Dollars in thousands)

Change in benefit obligation:

Benefit obligation at the beginning of the year $ 11,023 $ 10,570

Service cost 619 515

Interest cost 644 593

Plan amendments — (71)

Actuarial (gain) or loss 345 (456)

Benefits paid (241) (128)

Benefit obligation at the end of the year $ 12,390 $ 11,023

Change in plan assets:

Fair value of plan assets at the beginning of the year $ — $ —

Employer contributions 241 128

Benefits paid (241) (128)

Fair value of plan assets at the end of the year $ — $ —

Reconciliations of funded status:

Funded (unfunded) status $ (12,390) $ (11,023)

Unrecognized actuarial (gain) loss 1,622 1,293

Unrecognized prior service cost (2,487) (2,781)

Accrued benefit liability $ (13,255) $ (12,511)

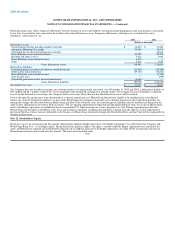

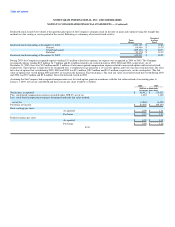

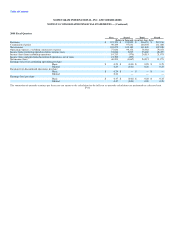

Benefits expected to be paid are $0.2 million, $0.3 million, $0.3 million, $0.4 million, $0.4 million and a combined $2.8 million for 2006, 2007, 2008, 2009,

2010 and for the five years starting 2011, respectively. Subsidies to be received under the Act beginning in 2006 are not expected to be material. The

Company will continue to make contributions to the plan to the extent benefits are paid.

The Company's actuarial valuation date for the postretirement plan is November 30. The weighted-average discount rate used to determine the actuarial

present value of the accumulated postretirement projected benefit obligation for the years ended December 31, 2005 and 2004 are is 5.90 percent and

6.00 percent, respectively. The weighted-average discount rates used to determine the net postretirement benefit cost for 2005, 2004 and 2003 are

6.00 percent, 6.25 percent and 6.75 percent, respectively. F-35