MoneyGram 2005 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

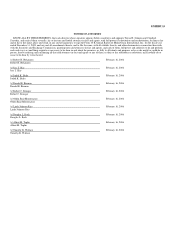

United Kingdom version

voting power of the then outstanding voting securities entitled to vote generally in the election of directors, as the case may be, of the Corporation or

other entity resulting from such Corporate Transaction (including, without limitation, a corporation or other entity which as a result of such transaction

owns the Corporation or all or substantially all of the Corporation's assets either directly or through one or more subsidiaries) in substantially the same

proportions as their ownership, immediately prior to such Corporate Transaction, of the Outstanding Corporation Common Stock and Outstanding

Corporation Voting Securities, as the case may be, (2) no Person (other than the Corporation or any entity controlled by the Corporation, any employee

benefit plan (or related trust) of the Corporation or any entity controlled by the Corporation or such corporation or other entity resulting from such

Corporate Transaction) will beneficially own, directly or indirectly, 20% or more of, respectively, the outstanding shares of Common Stock of the

Corporation or other entity resulting from such Corporate Transaction or the combined voting power of the outstanding voting securities of the

Corporation or such other entity entitled to vote generally in the election of directors except to the extent that such ownership existed prior to the

Corporate Transaction and (3) individuals who were members of the Incumbent Board will constitute at least a majority of the members of the board of

directors of the corporation resulting from such Corporate Transaction; and further excluding any disposition of all or substantially all of the assets of the

Corporation pursuant to a spin-off, split-up or similar transaction (a "Spin-off") if, immediately following the Spin-off, the Prior Stockholders

beneficially own, directly or indirectly, more than 80% of the outstanding shares of common stock and the combined voting power of the then

outstanding voting securities entitled to vote generally in the election of directors of both entities resulting from such transaction, in substantially the

same proportions as their ownership, immediately prior to such transaction, of the Outstanding Corporation Common Stock and Outstanding Corporation

Voting Securities, respectively; provided, that if another Corporate Transaction involving the Corporation occurs in connection with or following a Spin-

off, such Corporate Transaction shall be analyzed separately for purposes of determining whether a Change in Control has occurred; or

(iv) The approval by the stockholders of the Corporation of a complete liquidation or dissolution of the Corporation.

(b) In the event of a Change in Control, this Option (to the extent outstanding as of the date such Change in Control is determined to have occurred) if not

then exercisable and vested shall become fully exercisable and vested to the full extent of the original grant.

7. Plan and Plan Interpretations as Controlling. This Option and the terms and conditions herein set forth are subject in all respects to the terms and

conditions of the Plan, which are controlling. The Plan provides that the Board may amend the Plan, and that the Committee shall administer the Plan. The

Grantee, by acceptance of this Option, agrees to be bound by said Plan and such Board and Committee actions.

8. Termination of the Plan; No Right to Future Grants. By entering into this Non-Qualified Stock Option Agreement, the Grantee acknowledges:

(a) that the Plan is discretionary in nature and may be suspended or terminated by the Corporation at any time; (b) that each grant of an Option is a one-time

benefit which does not create any contractual or other right to receive future grants of Options, or benefits in lieu of Options; (c) that all determinations with

respect to any such future grants, including, but not limited to, the times when the Option shall be granted, the number of Shares subject to each Option, the

Option price, and the time or times when each Option shall be exercisable, will be at the sole discretion of the Corporation; (d) that the Grantee's participation

in the Plan shall not create a right to further employment with the Grantee's employer and shall not interfere with the ability of the Grantee's employer to

terminate the Grantee's employment relationship at any time with or without cause; (e) that the Grantee's participation in the Plan is voluntary; (f) that the

value of the Options is an extraordinary item of compensation which is outside the scope of the Grantee's employment contract, if any; (g) that the Option is

not part of normal and expected compensation for purposes of calculating any severance, resignation, bonuses, pension or retirement benefits or similar

payments; (h) that the right to purchase Common Stock ceases upon termination of employment for any reason except as may otherwise be explicitly provided

in the Plan or this Option Agreement; (i) that the future value of the Shares is unknown and cannot be predicted with certainty; (j) that if the underlying Shares

do not increase in value, the Option will have no value; and (k) the foregoing terms and conditions apply in full with respect to any prior Option grants to

Grantee. 6