MoneyGram 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

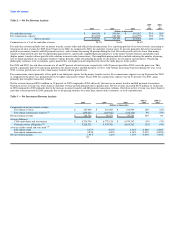

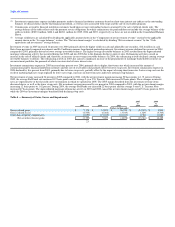

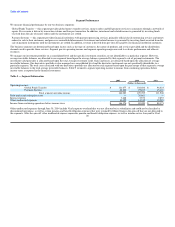

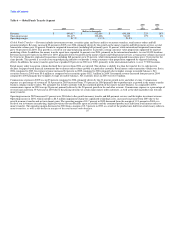

Table of Contents

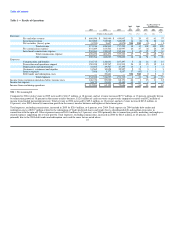

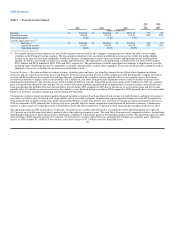

Transaction and operations support costs were up 19 percent in 2004 over 2003, partially driven by the $4.5 million impairment of capitalized technology

costs related to the discontinued development of a project with Concorde EFS and other discontinued projects and the $2.1 million impairment of intangible

assets related to a purchased customer list for an expected customer departure. The remaining increase in transaction and operations support expense is driven

primarily by higher insurance costs, public company costs and higher provisions for uncollectible agent receivables. The higher provision for uncollectible

agent receivables is primarily the result of losses experienced in the check casher channel.

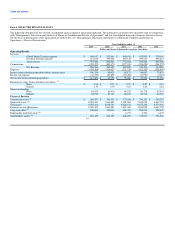

Depreciation and amortization — Depreciation and amortization includes depreciation on point of sale equipment, computer hardware and software

(including capitalized software development costs), and office furniture, equipment and leasehold improvements. Depreciation and amortization increased ten

percent in 2005 compared to 2004, primarily due to the amortization of our investment in computer hardware and capitalized software to enhance the money

transfer platform and the amortization of leasehold improvements (offset by a corresponding reduction in rent expense). Our investments in computer

hardware and software helped drive the growth in the money transfer product. Depreciation and amortization expense was up eight percent in 2004 over 2003,

primarily due to the amortization of computer hardware and capitalized software developed to enhance the money transfer platform.

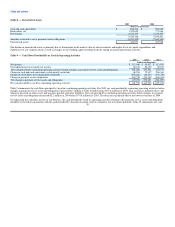

Occupancy, equipment and supplies — Occupancy, equipment and supplies includes facilities rent and maintenance costs, software and equipment

maintenance costs, freight and delivery costs, and supplies. Included in 2004 are $0.4 million of expenses allocated from Viad that did not recur in 2005.

Occupancy, equipment and supplies increased two percent in 2005 compared to 2004, primarily driven by software and asset maintenance, partially offset by

rent reductions from the amortization of lease incentives. Software expense and maintenance increases relate primarily to purchased licenses to support our

growth and compliance initiatives, as well as licensing costs which were incurred by Viad prior to the spin-off. Occupancy, equipment and supplies in 2004

increased 21 percent over 2003, primarily due to normal increases in facilities rent, higher software maintenance costs and losses on disposal of equipment.

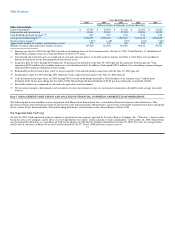

Interest expense — Interest expense increased 37 percent in 2005 as compared to 2004, primarily driven by expenses related to the amendment of our bank

credit facility and rising interest rates. In connection with the amendment of our $350.0 million bank credit facility in the second quarter of 2005, we expensed

$0.9 million of unamortized financing costs related to the original facility. See "Management's Discussion and Analysis — Other Funding Sources and

Requirements" for further information regarding the amendment of our bank credit facility. Interest expense declined 43 percent in 2004 as compared to 2003

on lower average outstanding debt balances and lower average interest rates. Viad paid down $249.6 million of debt in 2004 in connection with the spin-off.

Beginning in the second half of 2004, interest expense incurred relates to the $150.0 million MoneyGram borrowed under its credit facility on June 30, 2004

in connection with the spin-off. Interest expense on this MoneyGram debt was $2.4 million in 2004, including amortization of deferred financing costs.

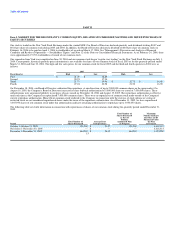

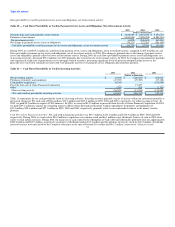

Debt tender and redemption costs — Debt tender and redemption costs incurred during 2004 of $20.7 million relate to the redemption of Viad's preferred

shares and tender for its subordinated debt and medium term notes in connection with the spin-off. No such costs were incurred in 2005 or 2003.

Income taxes — The effective tax rate was 23.3 percent in 2005, compared to 26.8 percent in 2004 and 14.2 percent in 2003. The corporate tax rate is lower

than the statutory rate due primarily to income from tax-exempt bonds in our investment portfolio. The tax rate in 2005 benefited from a reduction in

provision of $5.6 million due to reversal of tax reserves no longer needed due to the passage of time and changes in estimates of tax amounts. These benefits

were offset by the decline in tax-exempt investment income as a percentage of total income. In addition, the 2004 effective tax rate was adversely affected by

the costs related to the redemption of Viad's redeemable preferred shares, which are not tax deductible. The 2004 effective tax rate is higher than 2003 mainly

due to the redemption costs. 25