MoneyGram 2005 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

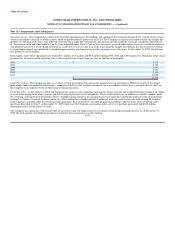

otherwise be paid to those employees, and receive matching credits with respect to such deferrals.

1.2. Definitions. When the following terms are used herein with initial capital letters, they shall have the following meanings:

1.2.1. Account — the separate bookkeeping account representing the separate unfunded and unsecured general obligation of the Employers established

with respect to each person who is a Participant in this Plan in accordance with Section 2 and to which is credited the amounts specified in Section 3 and

Section 4, which will vest in accordance with Section 5 and from which are subtracted payments made pursuant to Section 6 and Section 7.

1.2.2. Affiliate — a business entity which is affiliated in ownership with MGI that is recognized as an Affiliate by MGI for the purposes of this Plan.

1.2.3. Annual Deferral Amount — an entry on the records of the Employers equal to the following amounts deferred in any one Plan Year equal to:

(a) with respect to a Participant in the Compensation deferral component of the Plan, that portion of a Participant's Compensation that a Participant

elects to defer for the Plan Year, along with any matching credits made thereon; and

(b) with respect to a Participant in the Incentive Pay deferral component of the Plan, that portion of a Participant's Incentive Pay that a Participant elects

to defer for a performance period and which is credited to the Plan during a Plan Year, along with any matching credits made thereon.

The Annual Deferral Amount shall be a bookkeeping entry only and shall be utilized solely as a device for the measurement and determination of the

amounts credited to a Participant's Account.

1.2.4. Beneficiary — a person designated in accordance with Section 7.4 to receive all or a part of the Participant's Account in the event of the

Participant's death prior to full distribution thereof. A person so designated shall not be considered a Beneficiary until the death of the Participant.

1.2.5. Chief Executive Officer — the chief executive officer of MGI.

1.2.6. Code — the Internal Revenue Code of 1986, as amended (including, when the context requires, all regulations, interpretations and rulings issued

thereunder).

1.2.7. Common Stock — common stock of MGI.

1.2.8. Compensation — Compensation as defined under the MoneyGram International, Inc. 401(k) Plan; provided, however, that Compensation for

purposes of this Plan shall be determined without regard to limitations imposed under section 401(a)(17) of the Code.

-2-