MoneyGram 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

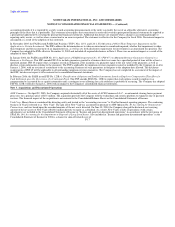

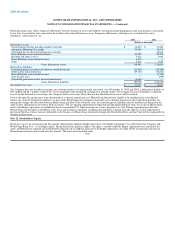

consent was increased. In connection with the amendment, the Company expensed $0.9 million of unamortized deferred financing costs relating to the

original bank credit facility during the quarter ended June 30, 2005. The Company also incurred $0.5 million of financing costs to complete the amendment.

These costs have been capitalized and will be amortized over the life of the debt. On December 31, 2005, the interest rate under the bank credit facility was

5.02 percent, exclusive of the effect of commitment fees and other costs, and the facility fee was 0.125 percent.

The loans under these facilities are unsecured obligations of MoneyGram, and are guaranteed on an unsecured basis by MoneyGram's material domestic

subsidiaries. The proceeds from any future advances may be used for general corporate expenses and to support letters of credit. Any letters of credit issued

reduce the amount available under the revolving credit facility (see Note 16). Borrowings under the facilities are subject to various covenants, including

interest coverage ratio, leverage ratio and consolidated total indebtedness ratio. The interest coverage ratio of earnings before interest and taxes to interest

expense must not be less than 3.5 to 1.0. The leverage ratio of total debt to total capitalization must be less than 0.5 to 1.0. The consolidated total indebtedness

ratio of total debt to earnings before interest, taxes, depreciation and amortization must be less than 3.0 to 1.0. At December 31, 2005, the Company was in

compliance with these covenants. There are other restrictions customary for facilities of this type, including limits on indebtedness, asset sales, merger,

acquisitions and liens.

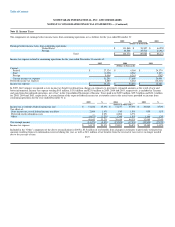

In September 2005, the Company entered into two interest rate swap agreements with a total notional amount of $150.0 million to hedge our variable rate

debt. These swap agreements are designated as cash flow hedges. At December 31, 2005, the two debt swaps had an average fixed pay rate of 4.3 percent and

an average variable receive rate of 3.9 percent. See Note 5 for further information regarding the Company's portfolio of derivative financial instruments.

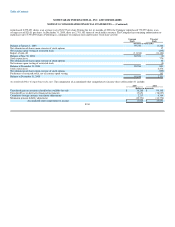

In connection with the spin-off, Viad repurchased substantially all of its outstanding medium-term notes and subordinated debentures in the amount of

$52.6 million. The amounts not paid off were retained by New Viad. Viad also repaid all of its outstanding commercial paper in the amount of $188.0 million

and retired its industrial revenue bonds of $9.0 million. The Company incurred a loss of $3.5 million in connection with these activities.

All amounts classified as debt on December 31, 2005 mature in June 2010. Total interest paid on outstanding debt was $5.8 million, $2.0 million and

$13.5 million in 2005, 2004 and 2003, respectively.

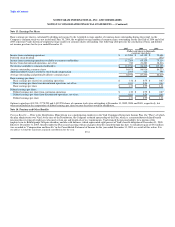

Note 10. $4.75 Preferred Stock Subject to Mandatory Redemption

At December 31, 2003, Viad had 442,352 authorized shares of $4.75 preferred stock that were subject to mandatory redemption provisions with a stated value

of $100.00 per share, of which 328,352 shares were issued. Of the total shares issued, 234,983 shares were outstanding at a net carrying value of $6.7 million,

and 93,369 shares were held by Viad. In connection with the spin-off, Viad redeemed its preferred stock for an aggregate call price of $23.9 million.

F-26