MoneyGram 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

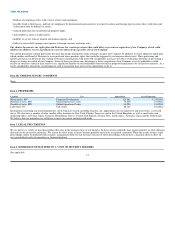

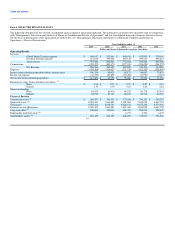

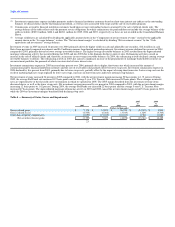

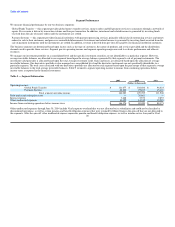

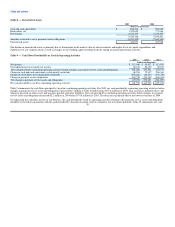

Table 1 — Results of Operations

As a Percentage of

2005 2004 Total Revenue

vs vs

2005 2004 2003 2004 2003 2005 2004 2003

(%)

(Dollars in thousands) (%) (%) (%) (%)

Revenue:

Fee and other revenue $ 606,956 $ 500,940 $ 419,002 21 20 62 61 57

Investment revenue 367,989 315,983 323,099 16 (2) 38 38 44

Net securities (losses) gains (3,709) 9,607 (4,878) NM NM (0) 1 (1)

Total revenue 971,236 826,530 737,223 18 12 100 100 100

Fee commissions expense 231,209 183,561 144,997 26 27 24 22 20

Investment commissions expense 239,263 219,912 232,336 9 (5) 25 27 31

Total commissions expense 470,472 403,473 377,333 17 7 49 49 51

Net revenue 500,764 423,057 359,890 18 18 51 51 49

Expenses:

Compensation and benefits 132,715 126,641 107,497 5 18 14 15 15

Transaction and operations support 150,038 120,767 101,513 24 19 15 15 14

Depreciation and amortization 32,465 29,567 27,295 10 8 3 4 4

Occupancy, equipment and supplies 31,562 30,828 25,557 2 21 3 3 3

Interest expense 7,608 5,573 9,857 37 (43) 1 1 1

Debt tender and redemption costs — 20,661 — NM NM 0 2 0

Total expenses 354,388 334,037 271,719 6 23 36 40 37

Income from continuing operations before income taxes 146,376 89,020 88,171 64 1 15 11 12

Income tax expense 34,170 23,891 12,485 43 91 4 3 2

Income from continuing operations $ 112,206 $ 65,129 $ 75,686 72 (14) 11 8 10

NM = Not meaningful

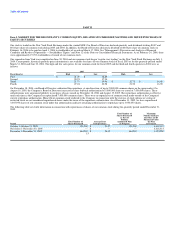

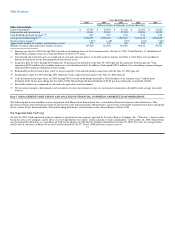

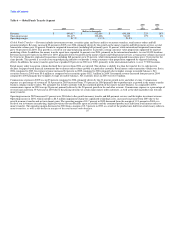

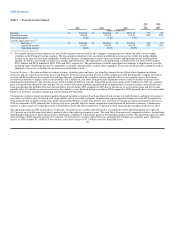

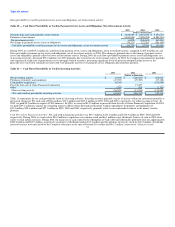

Compared to 2004, total revenue in 2005 increased by $144.7 million, or 18 percent, and net revenue increased $77.7 million, or 18 percent, primarily driven

by transaction growth of 38 percent in the money transfer business, $12.6 million of cash recoveries on previously impaired securities and $6.2 million of

income from limited partnership interests. Total revenue in 2004 increased by $89.3 million, or 12 percent, and net revenue increased $63.2 million, or

18 percent, over 2003, driven by transaction growth in the money transfer business and higher net investment gains.

Total expenses, excluding commissions, increased in 2005 by $20.4 million, or 6 percent, over 2004. Total expenses in 2004 include debt tender and

redemption costs of $20.7 million related to the redemption of Viad's preferred shares and tender for its subordinated debt and medium term notes in

connection with the spin-off. Other expenses increased $41.0 million, or 13 percent, over 2004 primarily due to transaction growth, marketing and employee-

related expenses supporting our revenue growth. Total expenses, excluding commissions, increased in 2004 by $62.3 million, or 23 percent, over 2003

primarily due to the 2004 debt tender and redemption costs and the same factors noted above.

21