MoneyGram 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

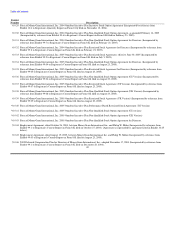

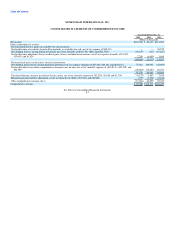

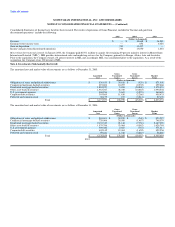

MONEYGRAM INTERNATIONAL, INC.

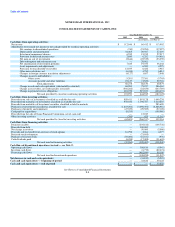

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

Unearned Accumulated

Employee Other Common

Common Additional Retained Benefits Comprehensive Stock in

Stock Capital Income and Other (Loss) Income Treasury Total

(Dollars in thousands, except per share data)

December 31, 2002 $ 149,610 $ 215,872 $ 781,441 $ (40,405) $ (87,531) $ (300,040) $ 718,947

Net income 113,902 113,902

Dividends ($0.36 per share) (31,603) (31,603)

Employee benefit plans 2,911 82 8,112 11,105

Treasury shares acquired (976) (976)

Unrealized foreign currency translation adjustment 2,848 2,848

Unrealized gain on available-for-sale securities 13,623 13,623

Unrealized gain on derivative financial instruments 44,086 44,086

Minimum pension liability (8,234) (8,234)

Contribution to Viad Corp Medical Plan Trust 4,881 4,881

Other, net 204 204

December 31, 2003 $ 149,610 $ 218,783 $ 863,944 $ (35,442) $ (35,208) $ (292,904) $ 868,783

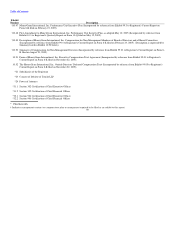

Spin off from Viad Corp (Note 3) (148,724) (139,051) (426,556) 287,775 (426,556)

Net income 86,412 86,412

Dividends ($0.20 per share) (17,409) (17,409)

Employee benefit plans 101 4,405 4,519 9,025

Treasury shares acquired (16,181) (16,181)

Unrealized foreign currency translation adjustment 1,807 1,807

Unrealized loss on available-for-sale securities (6,115) (6,115)

Unrealized gain on derivative financial instruments 68,445 68,445

Minimum pension liability (3,238) (3,238)

Other, net 218 218

December 31, 2004 $ 886 $ 79,833 $ 506,609 $ (31,037) $ 25,691 $ (16,791) $ 565,191

Net income 112,946 112,946

Dividends ($0.07 per share) (6,058) (6,058)

Employee benefit plans 205 5,636 10,075 15,916

Treasury shares acquired (50,000) (50,000)

Unrealized foreign currency translation adjustment (4,127) (4,127)

Unrealized loss on available-for-sale securities (60,860) (60,860)

Unrealized gain on derivative financial instruments 51,678 51,678

Minimum pension liability (557) (557)

December 31, 2005 $ 886 $ 80,038 $ 613,497 $ (25,401) $ 11,825 $ (56,716) $ 624,129

See Notes to Consolidated Financial Statements

F-9