MoneyGram 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

fails to meet the contractual terms of the derivative contract, the Company's risk is limited to the fair value of the instrument. The Company actively monitors

its exposure to credit risk through the use of credit approvals and credit limits, and by selecting major international banks and financial institutions as

counterparties. The Company has not had any historical instances of non-performance by any counterparties, nor does it anticipate any future instances of

non-performance.

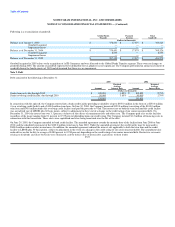

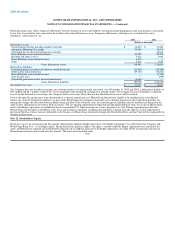

Note 6. Sale of Receivables

The Company has an agreement which expires in June 2006 to sell undivided percentage ownership interests in certain receivables, primarily from our money

order agents. The Company sells its receivables under this agreement to accelerate the cash flow available for investments. The receivables are sold to two

commercial paper conduit trusts and represent a small percentage of the total assets in each trust. The Company's rights and obligations are limited to the

receivables transferred, and the transactions are accounted for as sales. The assets and liabilities associated with the trusts, including the sold receivables, are

not recorded or consolidated in our financial statements. Under the agreement, the aggregate amount of receivables sold at any time cannot exceed

$450.0 million. The balance of sold receivables as of December 31, 2005 and 2004 was $299.9 million and $345.5 million, respectively. The average

receivables sold approximated $389.8 million and $404.6 million during 2005 and 2004, respectively. The agreement includes a 5% holdback provision of the

purchase price of the receivables. This expense of selling the agent receivables is included in the Consolidated Statement of Income in "Investment

commissions expense" and totaled $16.9 million, $9.9 million and $9.5 million during 2005, 2004 and 2003, respectively.

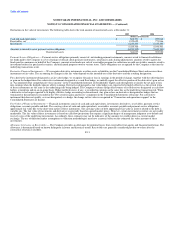

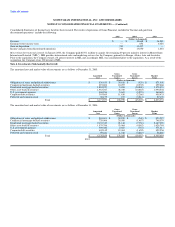

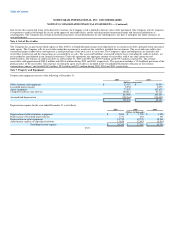

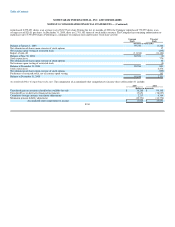

Note 7. Property and Equipment

Property and equipment consists of the following at December 31:

2005 2004

(Dollars in thousands)

Office furniture and equipment $ 23,167 $ 15,094

Leasehold improvements 8,952 5,072

Agent equipment 77,979 102,679

Computer hardware and software 104,811 81,712

214,909 204,557

Accumulated depreciation (109,364) (116,403)

$ 105,545 $ 88,154

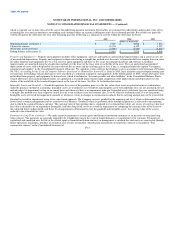

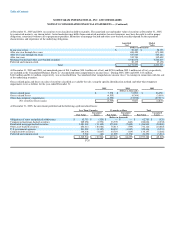

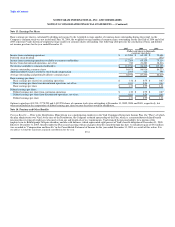

Depreciation expense for the year ended December 31 is as follows:

2005 2004 2003

(Dollars in thousands)

Depreciation of office furniture, equipment, $ 2,043 $ 1,790 $ 1,928

Depreciation of leasehold improvements 1,714 482 391

Depreciation on agent equipment 12,732 12,776 12,561

Amortization expense of capitalized software 13,854 12,453 10,514

Total depreciation expense $ 30,343 $ 27,501 $ 25,394

F-23