MoneyGram 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

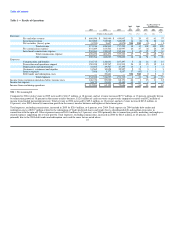

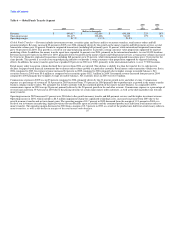

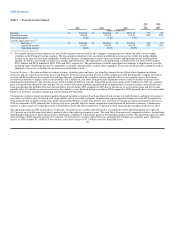

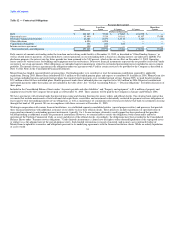

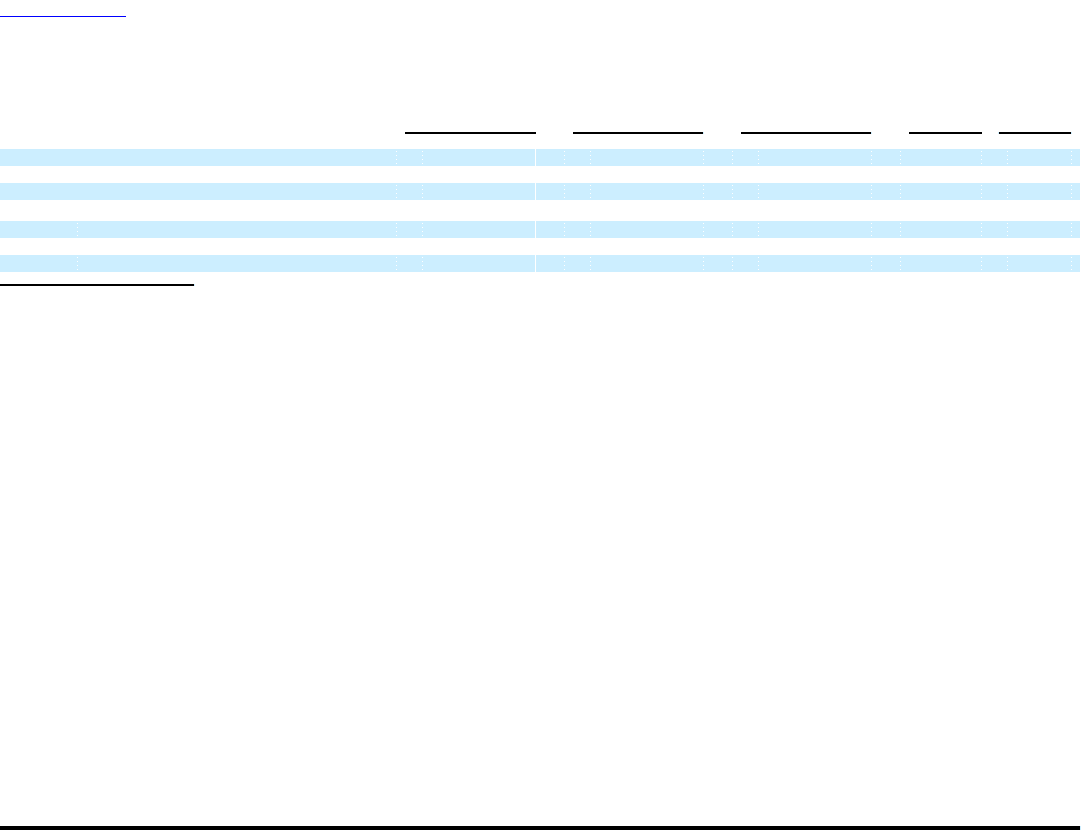

Table 7 — Payment Systems Segment

2005 2004

vs vs

2005 2004 2003 2004 2003

(Dollars in thousands)

Revenue $ 321,619 $ 294,466 $ 287,115 9% 3%

Operating income 42,406 27,163 15,123 56% 80%

Operating margin 13.2% 9.2% 5.3%

Taxable equivalent basis (1):

Revenue $ 340,655 $ 315,207 $ 312,627 8% 1%

Operating income 61,441 47,905 40,635 28% 18%

Operating margin 18.0% 15.2% 13.0%

(1) The taxable equivalent basis numbers are non-GAAP measures that are used by the Company's management to evaluate the effect of tax-exempt

securities on the Payment Systems segment. The tax-exempt investments in the investment portfolio have lower pre-tax yields, but produce higher

income on an after-tax basis than comparable taxable investments. An adjustment is made to present revenue and operating income resulting from

amounts invested in tax-exempt securities on a taxable equivalent basis. The adjustment is calculated using a 35 percent tax rate and is $19.0 million,

$20.7 million and $25.5 million for 2005, 2004 and 2003, respectively. The presentation of taxable equivalent basis numbers is supplemental to results

presented under GAAP and may not be comparable to similarly titled measures used by other companies. These non-GAAP measures should be used in

addition to, but not as a substitute for measures presented under GAAP.

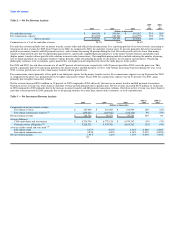

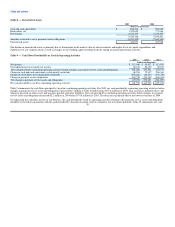

Payment Systems — Revenue includes investment revenue, securities gains and losses, per-item fees charged to our official check financial institution

customers and fees earned on our rebate processing business. Revenue increased nine percent in 2005 compared to 2004 due primarily to higher investment

revenue and $2.2 million of fee revenue received upon the early termination of a customer contract, partially offset by net securities losses. Investment

revenue increased due to higher yields on the portfolio, $10.1 million of cash flows from previously impaired securities and $5.0 million of income from

limited partnership interests. Net securities losses of $2.9 million in 2005 are a decline from 2004 net securities gains of $7.3 million. In 2004, net securities

gains were positively affected by the early pay off of a security held in the portfolio, partially offset by impairments of certain securities and realized losses

from repositioning the portfolio. Revenue increased three percent during 2004 compared to 2003 due to an increase in net securities gains and fee revenue,

partially offset by a decline in investment revenue. Investment revenue declined four percent during 2004 compared to 2003 primarily due to lower investable

balances as the heavy consumer refinancing activity during 2003 declined.

Commissions expense includes payments made to financial institution customers based on official check average investable balances and short-term interest

rate indices, as well as costs associated with swaps and the sale of receivables program. Commissions expense increased eight percent in 2005 compared to

2004, primarily due to higher commissions paid to financial institutions as short-term interest rates increased. Commissions expense declined six percent in

2004 as compared to 2003, primarily due to lower swap costs, partially offset by higher commissions paid to financial institution customers. Commissions

expense as a percentage of revenue decreased to 69 percent in 2005 and 2004 compared to 75 percent in 2003, primarily due to higher swap costs in 2003.

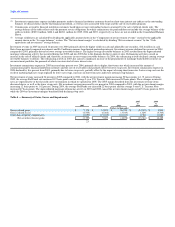

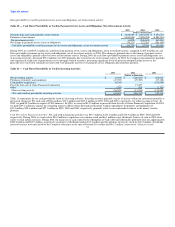

The operating margin in 2005 increased to 13.2 percent (18.0 percent on a taxable equivalent basis) as compared to 2004 operating margin of 9.2 percent

(15.2 percent on a taxable equivalent basis), primarily due to the higher investment revenue. The cash flows from previously impaired securities, income from

limited partnership interests and termination fee contributed a combined 4.9 percentage points to the operating margin in 2005. The operating margin for 2004

increased from a 2003 operating margin of 5.3 percent (13.0 percent on a taxable equivalent basis), primarily due to higher net securities gains. Operating

income in 2004 includes $7.3 million of net securities gains and a charge of $2.1 million related to intangible assets.

28