MoneyGram 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

• burdens of complying with a wide variety of laws and regulations;

• possible fraud or theft losses, and lack of compliance by international representatives in remote locations and foreign legal systems where collection and

enforcement may be difficult or costly;

• reduced protection for our intellectual property rights;

• unfavorable tax rules or trade barriers;

• inability to secure, train or monitor international agents; and

• failure to successfully manage our exposure to foreign currency exchange rates.

Our charter documents, our rights plan and Delaware law contain provisions that could delay or prevent an acquisition of our Company, which could

inhibit your ability to receive a premium on your investment from a possible sale of our Company.

Our charter documents contain provisions that may discourage third parties from seeking to acquire our Company. In addition, we have adopted a rights plan

which enables our Board of Directors to issue preferred share purchase rights that would be triggered by certain prescribed events. These provisions and

specific provisions of Delaware law relating to business combinations with interested stockholders may have the effect of delaying, deterring or preventing a

merger or change in control of our Company. Some of these provisions may discourage a future acquisition of our Company even if stockholders would

receive an attractive value for their shares or if a significant number of our stockholders believed such a proposed transaction to be in their best interests. As a

result, stockholders who desire to participate in such a transaction may not have the opportunity to do so.

Item 1B. UNRESOLVED SEC COMMENTS

None.

Item 2. PROPERTIES

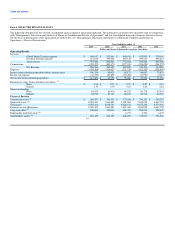

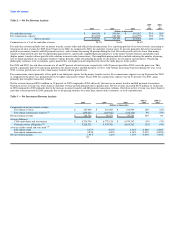

Location Use Square Feet Lease Expiration

Minneapolis, MN Corporate Headquarters 173,662 12/31/2015

Brooklyn Center, MN Global Operations Center 75,000 1/31/2012

Brooklyn Center, MN Global Operations Center 44,000 1/31/2012

Lakewood, CO Call Center 68,165 3/31/2012

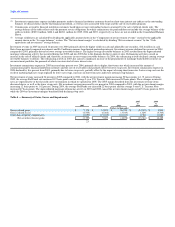

Information concerning our material properties, all of which are leased, including location, use, approximate area in square feet and lease terms, is set forth

above. We also have a number of other smaller office locations in New York, Florida, Tennessee and in the United Kingdom, as well as small sales and

marketing offices in France, Spain, Germany, Hong Kong, Greece, United Arab Emirates, Russia, Italy, South Africa, Australia, China and the Netherlands.

We believe that our properties are sufficient to meet our current and projected needs.

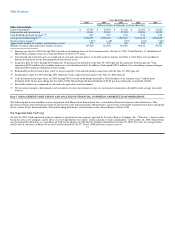

Item 3. LEGAL PROCEEDINGS

We are party to a variety of legal proceedings that arise in the normal course of our business. In these actions, plaintiffs may request punitive or other damages

that may not be covered by insurance. We accrue for these items as losses become probable and can be reasonably estimated. While the results of these legal

proceedings cannot be predicted with certainty, management believes that the final outcome of these proceedings will not have a material adverse effect on

our consolidated results of operations or financial position.

Item 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

Not applicable. 14